When the federal government last raised the gas tax, Hillary Clinton was the first lady of the United States. Mark Zuckerberg was a nerdy nine-year-old in suburban New York. America’s interstate highway system was aging, but working just fine.

Oh, how far the country has come since August of 1993, and how far its infrastructure has not come The motor vehicle gas tax – those 18.4 cents that get tacked onto every gallon sold in the U.S. – remains the primary funder of the road, bridge and transit system. And even as inflation does its thing, cars grow more efficient, and the federal government’s transportation network expands, widens, and, yes, breaks, legislators steadfastly refuse to hike the thing. Now the Department of Transportation estimates the entire system will take at least $84 billion to maintain, not improve, each and every year.

Until now, maybe. Last month President Trump said he might go beyond 18.4 cents on the gallon.

“It’s something that I would certainly consider,’’ he said

Seems reasonable: The gas tax makes drivers pay for the roads they use. Higher tax, more money. Cue the minor congressional freak out.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

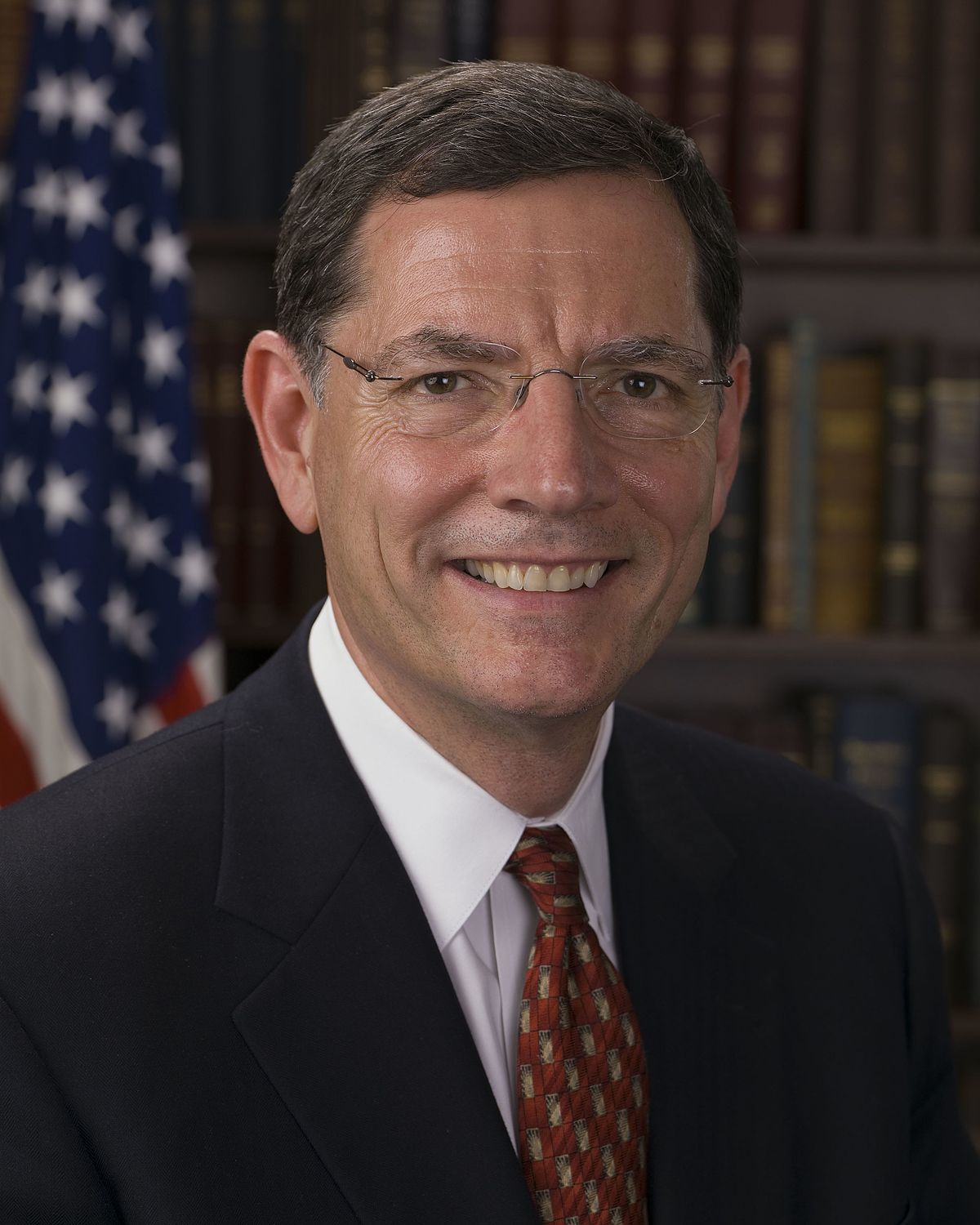

Stay InformedSenator John Barrasso, a Wyoming Republican and chair of the Environment and Public Works Committee

“I oppose raising taxes, and I oppose adding to the debt,’’ said Senator John Barrasso, a Wyoming Republican and chair of the Environment and Public Works Committee.

This tax hasn’t budged in 24 years because it sits at the center of a curious ideological swirl, frustrating moderates while drawing the ire of fiscal conservatives and social progressives alike. It appears grounded in the simplest of realities, but symbolizes the hyper-partisan political climate that makes it hard for Washington to do almost anything.

The federal gas tax has funded infrastructure since 1931, when the government added a single cent to the price of each gallon sold. Today, drivers’ 18.4 cents (24.4 if you’re burning diesel) go to the Highway Trust Fund, the bank account that funds surface transportation like roads and mass transit. (Drivers also pay state gas taxes, ranging from 59 cents in Pennsylvania to 16.8 cents in South Carolina.

Jeff Davis, a senior fellow with the Eno Center for Transportation

“In the 1970s, Congress ordered the EPA and National Highway Traffic Safety Administration to declare war on the funding source for the Federal Highway Administration,’’ said Jeff Davis, a senior fellow with the Eno Center for Transportation.

Since 2008, the Highway Trust Fund has taken in less money than it has disbursed. In two successive federal transportation bills, lawmakers shoveled in cash from a discretionary fund to make sure the infrastructure system doesn’t collapse. The last big transportation bill, passed in 2015 and good through 2020, kicked an extra $70 billion to the fund. If the next bill doesn’t include a stable source of funding, the shortfall will hit $103 billion by 2027.

Who wants to do what?

A constellation of politicians and interest groups, including the US Chamber of Commerce, AAA, and the American Trucking Association, want to fix the problem for good by raising the gas tax. If the country wants better infrastructure, they reason, it must pay for it. Many Democrats, including top House Transportation and Infrastructure Committee Rep. Peter DeFazio, have pushed this option for years.

Not everyone agrees. Some progressives criticize the gas tax as regressive. Low-income drivers miss those 18.4 cents more than rich ones, and are more likely to drive older, less fuel-efficient cars.

“Bill Gates probably drives a Tesla and Joe Minimum Wage drives a gas guzzler,’’ Davis said.

Rural folks, who are overwhelmingly Trump voters, would take an especially hard hit, since their non-car transportation options range from limited to zilch.

Anti-tax conservatives loathe the idea not just because they’re anti-tax, but because those rural areas are pretty darn red right now.

Historically, conservative politicians have danced around this question by painting the gas tax as a user fee — that’s how Ronald Reagan managed to pass a fuel tax hike in 1982. It’s tricky, though. Voters didn’t buy the same argument from George H. W. Bush, who increased the tax in 1990 after his famous “no new taxes” promise. (His gas tax hike is credited in part for his loss to Bill Clinton.) Clinton, meanwhile, passed an economic plan including a gas tax hike and took fire from Republicans.

Is this a political no-go?

Probably. An infrastructure or tax reform bill with a higher gas tax would provide Trump with a much-needed opportunity to bring in centrist Democrats and Republicans to actually fix some stuff. There’s little reason to believe that this is going to make it past Congress, where the Republicans generally reacted with alarm.

So what now?

This is debate that goes back decades. Trump has indicated that a $1 trillion infrastructure funding infusion, led by partnerships with the private sector, could help out. Maybe, but the plan as flaws. The government could also choose to charge drivers for exactly what they’re driving, an actual user fee – something states like Oregon and California are trying out. Or it could just keep plugging the gap with more and more money from elsewhere in the budget.

One more option: Let the states take over all of the country’s infrastructure. Even a few red ones (Nebraska, Georgia) have shown they’re willing to raise local gas taxes.

“The closer the level of government is to the voter, the easier it is to show the voter exactly what they’ll be getting for their money,’’ Davis said.

Others have shown more willingness to get creative about funding, like imposing heavier registration fees on electric and hybrid vehicles. Thinking caps on, America, because someone’s going to have to find this money somewhere.

(This article was reported by Wired.com)