Tractor Weights Climbing NACFE Report Says

The North American Council for Freight Efficiency (NACFE) has issued an updated report on the changing trends of light-weighting technologies since the council last published a study on the topic in 2015, including strategies to deal with increased tractor weights.

The study team interviewed more than 50 companies, including fleets, tractor and trailer manufacturers, suppliers and technology companies, and confirmed that the weight of tractors (and to some degree trailers) has increased, while freight is becoming denser, and shippers are loading more pallets per trailer.

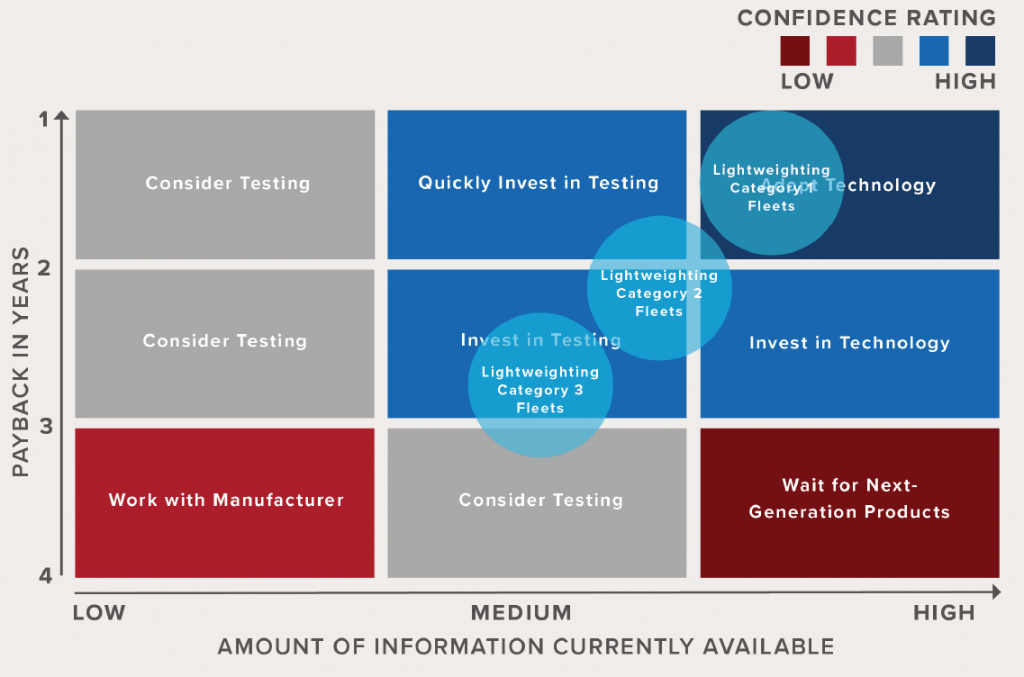

NACFE developed several tools including a Confidence Matrix, decision guide and payback calculator to assist fleets in evaluating lightweighting. The Confidence Matrix shows how confident NACFE is in the adoption case for lightweighting.

Three Categories

Currently, the market can be divided into three categories with respect to weight sensitivity and the percent of time that fleets are requested to gross out.

- Category 1: Trucks that currently travel at the 80,000-pound limit at some point along nearly 100 percent of their routes. This represents a small percentage of the industry (about 2 percent). This segment consists of bulk carriers.

- Category 2: Trucks that are loaded to the maximum weight (gross out) on a minority, perhaps 10 percent, of their trips. This represents about 10 percent of the trucks on the road, mostly refrigerator units but also some dry van routes.

- Category 3: Dry van units that rarely (2 percent of the time) or never travel at maximum weight, either because they are filled to maximum volume (cube out) before they gross out, or simply because their routes and cargo patterns are not conducive to traveling full. About 88 percent of the trucking industry falls into this category.

The study found that bulk carriers are willing to pay $6 to $11 up front cost per pound of weight saved, and that the majority of bulk haulers have already invested in lightweight technologies. Meanwhile, reefers and some dry van fleets are willing to pay $2 to $5 per pound of weight saved, and fleets with dry van units that rarely travel at maximum weight are willing to pay up to $2 per pound of weight saved.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedNext 5 to 10 years

NACFE found that over the next five to 10 years, shippers will request that Category 2 and Category 3 trucks double the percent of time they gross out, to 20 percent of the time for Category 2 and 4 percent of the time for Category 3.

In order to meet these trends head-on and accommodate the heavier, denser freight, Category 2 and 3 fleets will have two options — add more trucks to the road, or explore light-weighting so that at least some of their trucks will be able to carry more freight. Light-weighting is by far the better option, NACFE officials said. Along with improving the overall freight efficiency of a fleet, light-weighting is a good investment because it opens the door for the adoption of additional beneficial technologies that might otherwise make a truck unacceptably heavier than it currently is.

Emissions regulations, combined with fuel economy features and driver amenities on today’s commercial vehicles, have added 1,000 pounds to the typical Class 8 truck, according to NACFE officials.

Fleets can save 2,000 pounds by investing to a limited degree in light-weighting and as much as 4,000 pounds with an aggressive investment. Light-weighting can take place in various areas of the tractor and trailer, including the power-train, axle suspensions, wheel ends, drive shaft, frame and fifth wheel.

Recommendations

The study team developed the following recommendations based on the trends officials recorded:

- Category 2 and Category 3 fleets should begin to explore and spec light-weighting technologies in order to improve freight efficiency. By doing so, they may even produce economies of scale that bring down the upfront cost of these technologies, while perhaps opening up new options for Category 1 fleets to adopt technologies that are currently too expensive.

- To bring down costs the industry should collaborate in order to address current redundancy in the development, testing, and product availability cycle among product developers, tractor-trailer integrators, and fleets.

The study also found that:

- Aluminum frame rails that were looked at five years ago are no longer available.

- Lightweight frame cross members are becoming more popular with new developments on the horizon.

- Both steel and aluminum wheel manufacturers have reduced wheel weight by five pounds since 2015.

- Electric trucks are 2,500 to 5,000 pounds heavier than their diesel counterparts for the same duty cycle.

- There are a number of new products in development, from film to replace paint to new frame processing and composite cab structures.