C Crestwood Equity Partners LP said it closed on the previously announced transaction to sell 100 percent of the equity interests of US Salt LLC (US Salt) to an affiliate of Kissner Group Holdings LP for $225 million, subject to working capital and minor maintenance capital adjustments.

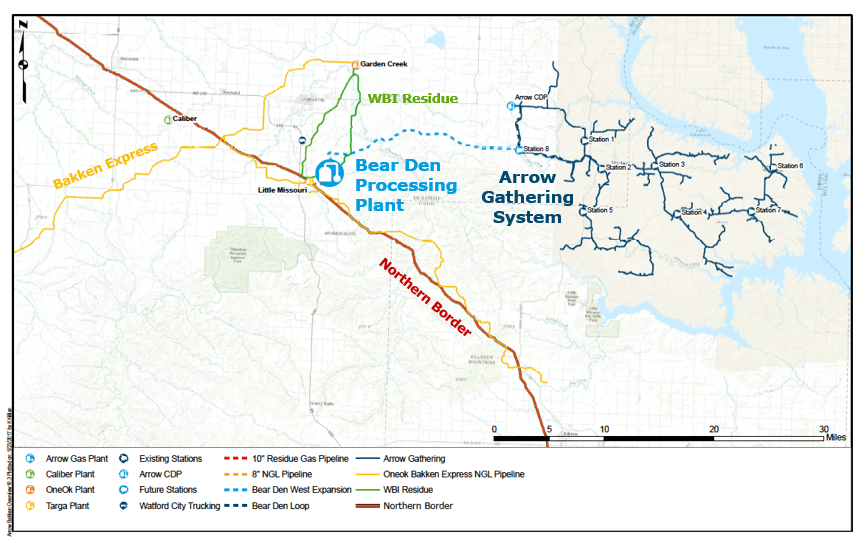

Crestwood also announced the commissioning of Phase 1 of the Bear Den gas processing plant in Watford City, N.D., adding 30 million cubic feet per day (MMcf/d) of processing capacity to support increasing gas volumes on Crestwood’s Arrow gathering system located on the Fort Berthold Indian Reservation.

Additionally, Crestwood said it has decided to proceed with Phase 2 expansion of the Bear Den gas processing plant with the addition of a new 120 MMcf/d cryogenic gas processing plant.

The Bear Den gas processing plants are supported by a 150,000 acreage dedication under long-term contracts with Crestwood’s multiple Arrow producers. Under these contracts, Crestwood purchases 100 percent of oil and gas volumes at the wellhead, allowing Crestwood full control of processing volumes. With Bear Den Phase 1’s 30 MMcf/d capacity in-service, Crestwood will substantially alleviate current curtailments from its third-party processor as well as current flared gas volumes and expects the plant to operate at full utilization by year’s end.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed

Crestwood Equity Partners – Bear Den Gas Processing Project

Phase 2 is a long-term processing solution that will be scaled to handle 100 percent of the processing requirements for producers on the Arrow system upon expiration of third-party processing contracts in the third quarter 2019. Crestwood expects to invest about $185 million on the Phase 2 expansion with a targeted in-service date in the second quarter 2019. Upon completion of the Phase 2 expansion, Crestwood will have a combined 150 MMcf/d of gas processing capacity in the Bakken.

Robert G. Phillips, chairman and chief executive of Crestwood’s general partner, said: “The Arrow system will be Crestwood’s largest growth driver in 2018 as our producers continue to invest in the Bakken due to very strong well-economics, increasing EURs, and a large inventory of well locations. We are pleased to commission the first phase of the Bear Den plant to give our producers enhanced flow assurance, more reliable service and improved net backs. We are investing in the Phase 2 expansion as our producer customers continue to aggressively develop their acreage on the Arrow system.

“Additionally, we are pleased to announce the closing of the divestiture of US Salt, a non-core business in Crestwood’s portfolio, for $225 million. This transaction is materially accretive to Crestwood’s current business plan as we expect to reinvest the proceeds into our high-growth Bakken and Delaware Basin footprints over 2018. Crestwood is committed to maintaining a strong balance sheet while self-funding our capital programs to maximize project returns and enhance DCF per unit value creation.’’

About Crestwood Equity Partners

Houston, Texas, based Crestwood Equity Partners is a master limited partnership that owns and operates midstream businesses in multiple unconventional shale resource plays across the United States. Crestwood is engaged in the gathering, processing, treating, compression, storage and transportation of natural gas; storage, transportation, termin