In the first half of the year, the spot market in Texas was boiling over, with not nearly enough trucks to cover the growing demand for freight. In the past month, the market’s been pretty tepid.

What happened?

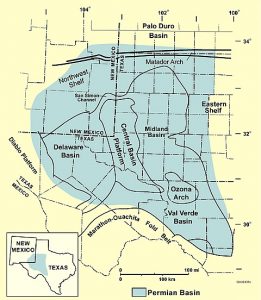

Pipeline capacity issues in West Texas are part of the explanation. Drilling in the Permian Basin around Midland, Texas, has slowed.

“Demand also cooled out of Houston, the largest flatbed market in the country and the top market supplying Midland and its surrounding counties,’’ according to Beaverton, Ore.-based DAT, a technology company operating a load board and providing data to the trucking industry. DAT is a division of Roper Industries.

Regional Markets in TX

Regional van markets like Dallas and Memphis — which send freight to Houston – seem to be impacted by the slowdown in oil drilling as well, according to DAT.

“This slowdown put a bit more capacity on the spot market during early August, as trends looked slightly sub-par compared with normal seasonality,’’ DAT said in a press release. “We usually see a slump in freight from mid-July to mid-August, but this year, even though rates stayed mostly high nationwide, Texas freight markets fell more than most.’’

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedGlut in the Permian Basin

At this time, the inability to quickly pipe oil to the Gulf Coast and other markets creates a glut in the Permian Basin, which brings down prices, according to DAT.

The West Texas Permian Basin (Courtesy of National Energy Technology Laboratory – US DOE, Public Domain)

“Looking ahead, even though drilling activity has slowed in the region, new pipeline projects are underway to expand capacity for all the completed wells,’’ the company said.

A number of pipelines have been completed or expanded this year, and more are coming in 2019. One of the issues these projects face is sourcing steel domestically due to the new steel tariffs. Some claim that the steel isn’t readily available or costs much more than imported steel prior to tariffs.

Other Regions Outperform

Other areas in the U.S. have shown higher flatbed activity, including the Cleveland, Ohio, and Decatur, Ala., markets and, more recently, Roanoke, Va., where flatbed prices spiked in September. While recent spot prices have trended down, longer term flatbed contract rates are up, rising from $2.04 per mile in August 2017 (excluding fuel surcharge) to $2.30 in August on a nationwide basis.

“It’s yet to be seen whether this new domestic activity outweighs the West Texas slowdown,’’ DAT said. “Also, stronger seasonal van and reefer trends are tightening many western markets. One thing we can count on is that change will continue to take place in the U.S. economy.’’