Gas Supply Glut Causing Uncertainty For LNG

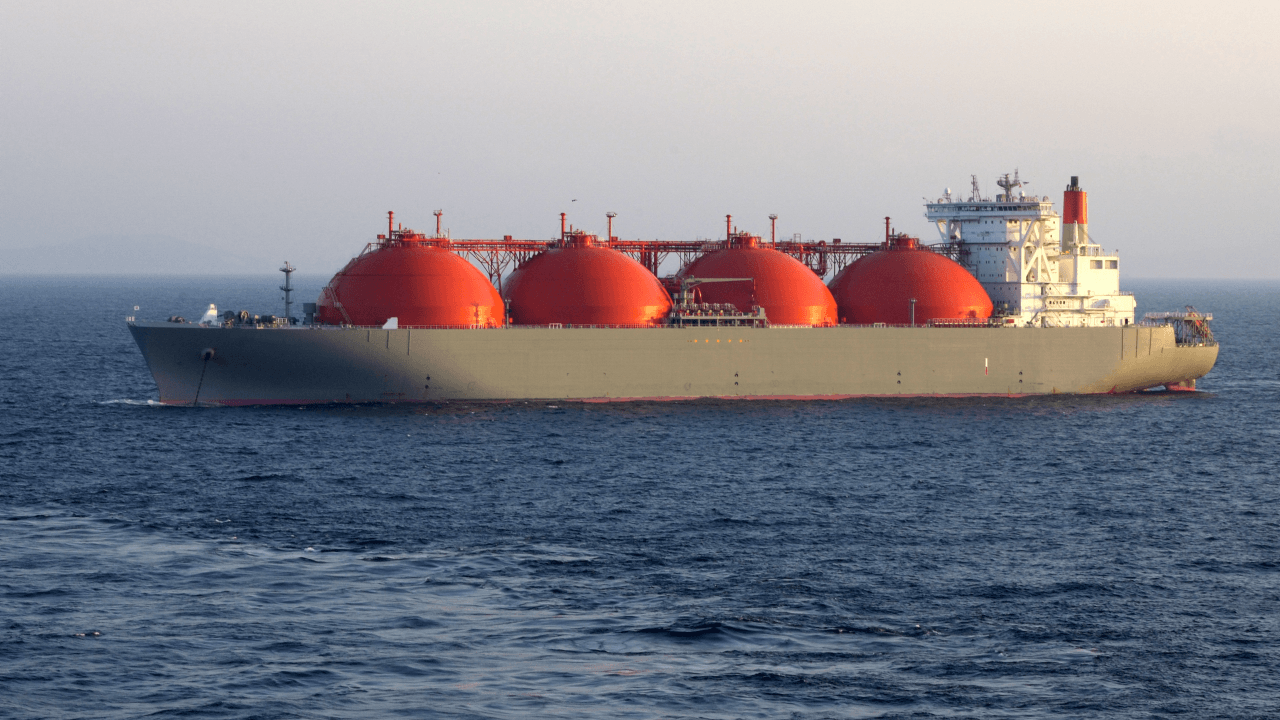

U.S. liquefied natural gas (LNG) exporters could see cargo cancellations return this summer if the current supply glut cannot be alleviated by then, analysts said recently.

According to IHS Markit, 2020 saw an estimated global surplus of around 24 million metric tons of LNG, or 6 percent of the available market, as demand weakened amid the coronavirus pandemic. This year, supplies are expected to grow by 3 percent, said research and analysis director James Taverner. He spoke with other experts about the outlook at CERAWeek hosed by IHS Markit.

James Taverner, Research and Analysis Director, IHSMarkit

“LNG demand would have to grow by something like 9 percent-plus to absorb all the surplus from last year, as well as the supply growth in 2021,” Taverner said. That could happen if the summer is particularly hot or there are supply outages, he said. However, many factors would have to line up in the same direction.

“So if a surplus does persist, as we think is likely, this summer we may see once again energy exports being turned down to balance the market just like last year,” Taverner said. In turn, that could lead to prices in Asia and Europe dropping toward North American levels.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed“If this happens, then once again, the key benchmark for global prices will be the U.S. Henry Hub.”

IHS Markit’s Matthew Palmer, senior director of global gas, said while some turndown in the LNG market is expected over the summer, it may not reach the same level as last year. Palmer expects U.S. inventories to reach around 3.5 Tcf, below the five-year average and almost 500 Bcf below levels at the end of 2020.

Matthew Palmer, Senior Director of Global Gas, IHS Markit

“If LNG exports somehow are a bit higher but stronger through the year, that could put some upside to natural gas prices, particularly the back half,” he said. He cited the recent volatility in Henry Hub pricing. The benchmark has ranged in the past four months from a low of $1.34/MMBtu to higher than $23.

“The lack of investment in drilling and completion activity in the U.S. in 2020 is going to start to manifest itself more and more as we go through the winter and into the spring,” Palmer said. “But we do see a stabilization in production with higher prices and both crude and natural gas in 2021. By the back half we see production grow.”