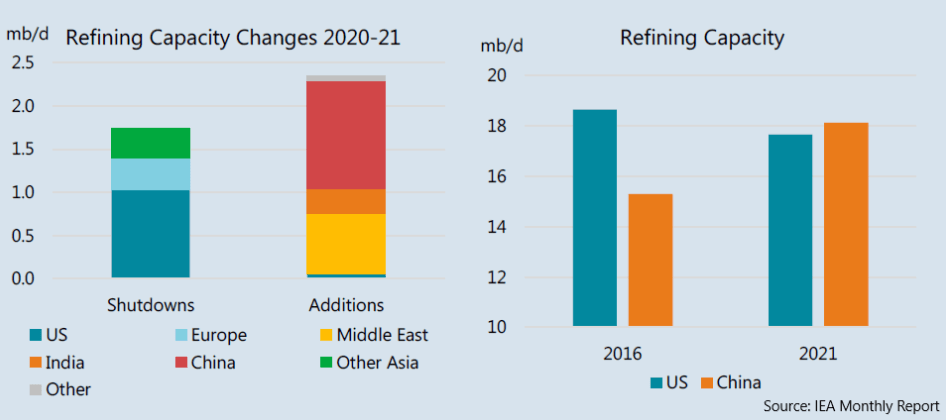

Refinery Closings Increasing 2020-2021

Permanent refining capacity closures expected for 2020-2021 have risen to about 1.7 million barrels per day (bpd) as the COVID-19 pandemic hammers demand for oil products, according to the International Energy Agency (IEA).

About a dozen refinery closures have been announced in the past few months, the IEA said, with the bulk of capacity closures – more than 1 million barrels per day (bpd) – happening in the United States.

“There were capacity shutdowns planned for 2020-2021 prior to COVID-19, but the bulk of the new announcements reflect pessimism about refining economics in a world suffering from temporary demand and collapse and structural refining overcapacity,’’ IEA said in its monthly report.

In 2019, global crude oil refining capacity stood at 102 million bpd, catering for 84 million bpd of refined oil products demand. That shrank to 76 million bpd in 2020 and is expected to be 80 million bpd in 2021, IEA said.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedLast month, Royal Dutch Shell said it would halve crude oil processing capacity and cut jobs at its 500,000-bpd Pulau Bukom oil refinery in Singapore.

In Europe, Petroineos plans to mothball nearly half of its 200,000 bpd refinery at Grangemouth in Scotland, and Gunvor will shutter its 110,000 bpd Antwerp oil refinery in Belgium.

Outlook Remains Mixed

The outlook for refining remains mixed, with traditionally low-value naptha and fuel oil possible bright spots in the new year, Vitol chief executive Russell Hardy told the Reuters Commodity Trading Summit.

He said the 1.6 to 1.7 million bpd of capacity closures already announced to take place by the end of this year to early next year could grow by a further 1 million bpd.

Plateauing fuel demand, tightening environmental rules and overseas competition have prompted several European and U.S. refiners to opt for converting plants to produce biofuels.