Semi-conductor Shortages Slow Truck Production

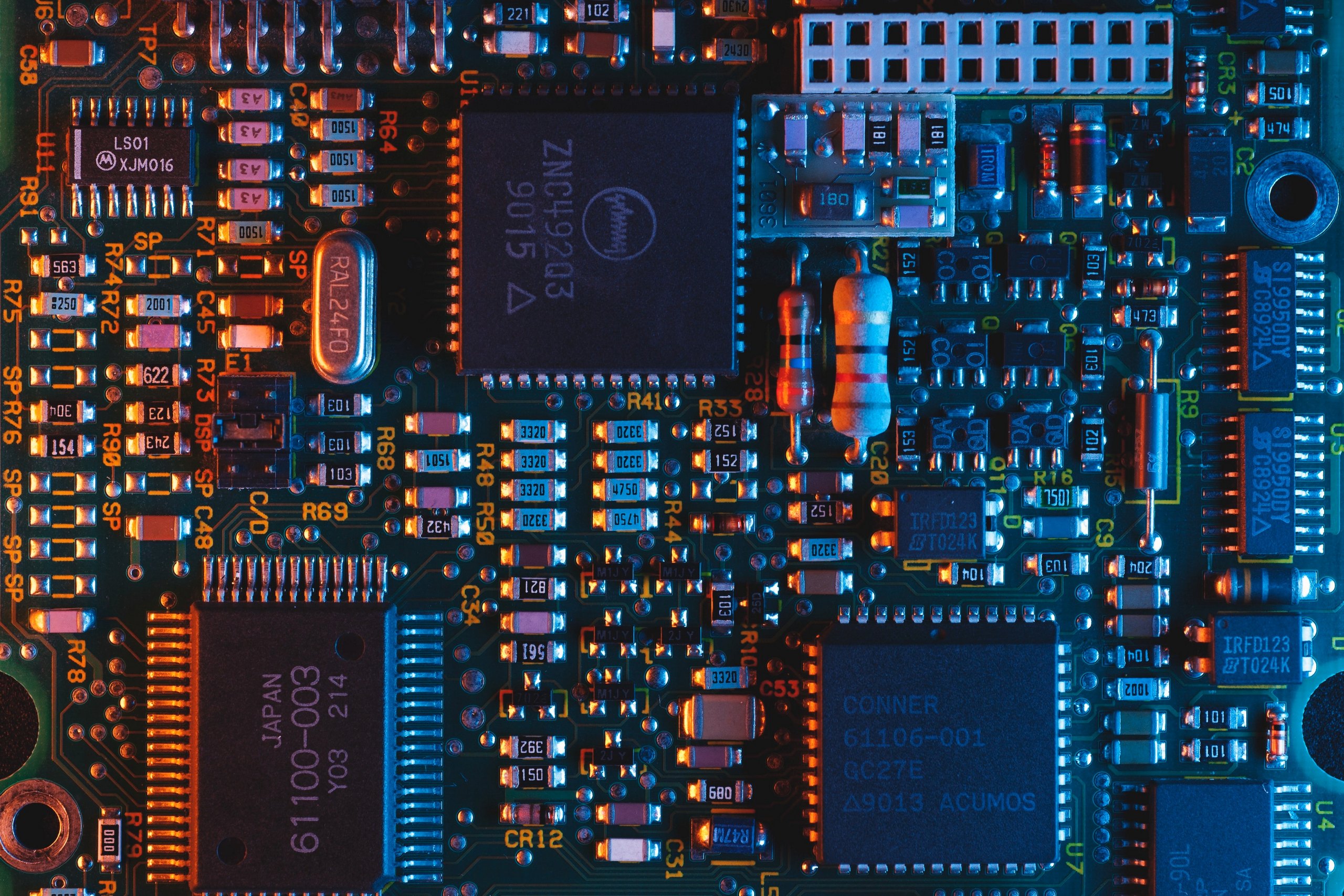

While significantly more trucks are needed to handle the freight growth generated by the economic recovery and government stimulus, truck production continues to be substantially limited by shortages of semi-conductors and various other components, according to research company FTR.

Semi-conductor Shortages Slow Truck Production

One such shortage is that of microchips, which has hobbled North American truck production over the past few weeks, according to Kevin Baney, Kenworth’s general manager.

“This chip shortage is primarily centered in Taiwan, where the bulk of microchips are manufactured as a result of the pandemic,” Baney said. “However, it was water damage at shipping facilities in Austin, Texas, coming in through Mexico, which ruined entire shipments of chips already shipped to the U.S. from overseas that created the short-term supply issue we’re facing now.”

Semi-conductor Shortages Slow Truck Production

There are no clear indications of when the supply-chain issues will be resolved, FTR officials said. For the next few months, computer chips will be in short supply and ports will be backed up, according to Don Ake, FTR’s vice president of commercial vehicles.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedMeanwhile, fleets continue to order in large quantities to secure trucks for future needs.

While preliminary North American Class 8 net orders for March were down about 10 percent compared with February numbers, March orders (about 40,000 units) were still up more than 33,000 units compared with March 2020, which was impacted by the pandemic, FTR officials said. Class 8 orders were 424 percent higher than March 2020, ACT officials said.

Semi-conductor Shortages Slow Truck Production

March was the sixth consecutive month exceeding the 40,000-unit threshold, a record. Class 8 orders now total 372,000 units for the past 12 months.

“There is tremendous pent-up demand being generated due to the constrictions on supply. The pressure in the market is building, as orders continue to flow into original equipment manufacturers (OEMs) at a record pace. To have this level of orders roll in for half a year is impressive and unprecedented,” Ake said. “It appears the industry will be playing catch-up well into the first half of next year.’’

Meanwhile, demand for Class 5-7 vehicles is up 19 percent from February numbers to 31,400 units.