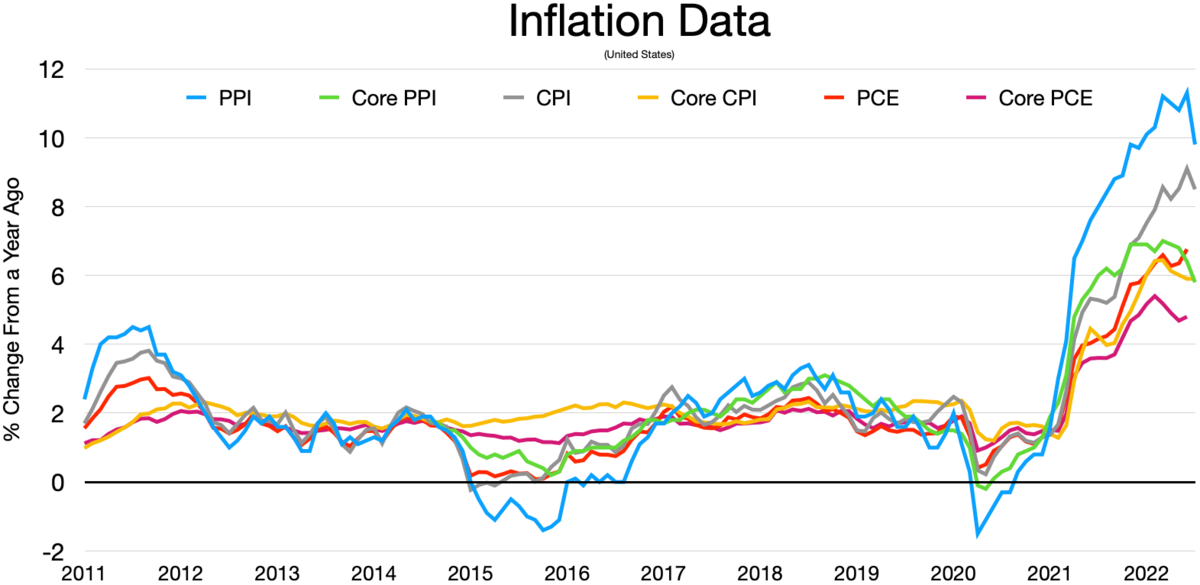

Rising CPI pressuring fleet operations, effecting cost of financing equipment and other cost such as maintenance and repair

Rising CPI Pressuring Fleet Operations – The CPI accelerated 8.3% in April, more than the 8.1% estimate and near the highest level in more than 40 years

Recent Consumer Price Index (CPI) increases are making front-page headlines across the country, with impacts seen and felt in every industry, including environmental. Sure, rising CPI directly correlates to the cost of financing equipment, but it can also have a significant ripple effect on other cost centers, such as maintenance and repair (M&R). Knowing how to navigate this, as well as understanding a fleet’s options, can potentially save millions toward the organization’s bottom line.

The CPI measures the price of many goods and services, including, groceries, clothes, restaurant meals, recreation and vehicles — light vehicles as well as commercial ones. According to a recent CPI report, price pressures remained elevated year-over-year. The CPI accelerated 8.3% in April, more than the 8.1% estimate and near the highest level in more than 40 years, according to analysts.

Fleet Executives Dealing with Inflation

One of the challenges fleets are facing today is that there has been little or no inflation for many years. There’s a whole generation of fleet professionals who have never had to deal with the CPI increase. They negotiated with their vendors for a long time and prices mostly remained stagnant. Now suddenly fleet operators are seeing 2, 3, and 4% increases and must evaluate their options to keep costs under control as much as possible. Moreover, they need to answer the C-suite and provide alternate options and recommendations.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedHow M&R Is Impacted by CPI Increases

M&R is a significant area where cost control options exist. First and foremost, depending on a lease’s structure — full-service or unbundled – fleets may have an important choice when understanding what is included in their M&R costs. There are variable inputs that make up these costs and it’s not as simple as just looking at M&R as a single bucket, per se. Fleets must be able to dissect all critical M&R parts and components, such as tires, brakes, service and repair, etc.

Knowing Your Lease Structure is Important

Knowing Your Lease Structure is Important – One of the most significant differences between an unbundled and full-service lease is how M&R costs are calculated.

Because of this, more fleet personnel are taking a closer look at unbundling their lease structure so they and their asset management partners can work with vendors and parts suppliers on the most cost-competitive components. However, in a full-service lease (FSL) structure, fleets are confined to a single, bottom-line figure with little power in negotiating.

One of the most significant differences between an unbundled and full-service lease is how M&R costs are calculated. M&R is “front loaded” in a FSL lease. Companies can pay a minimum of .07 per mile in year one versus .02 per mile when unbundling. All trucks have a two-year bumper-to-bumper warranty that can be extended to four years. Expenses for year one include wearable items (tires, brakes) and preventive maintenance. A shorter truck life cycle produces long-term savings beyond the first year. In an unbundled lease, the cost per mile average equals 5.675 cents over five years. However, in an FSL, fleets pay up to 9 cents per mile.

Rising CPI exacerbates this further since those rates are not flat. If the CPI increases, as it has recently, fleets will undoubtedly see an increase in their monthly payment.

Why It’s Important To Itemize M&R Costs

Why It’s Important To Itemize M&R Costs – Review efficiencies to show how rising costs are affecting scheduled maintenance, preventative maintenance, tire and brakes replacement, etc.

However, when we look at each of those pressures fleet professionals have to deal with, they also have the internal pressures of explaining it all to their leadership. The fleet professional speaks for each individual cost center buckets — truck procurement, fuel, financing costs, M&R, etc. It becomes very difficult to pinpoint precisely where rising CPI is having the most significant impact on the bottom line. However, when fleet personnel have each cost center unbundled and broken out individually, they can go line item by line item and review efficiencies in each bucket to show how rising costs are affecting scheduled maintenance, preventative maintenance, tire and brakes replacement, etc.

In many of these lease agreements, fleets have the maintenance included and additional time and materials on top. Therefore, they’re seeing the CPI increase in general and in parts that can be anywhere from 15% to 30% on the individual items. Parts availability and supply chain shortages further complicate this.

So, if a fleet typically runs 500 tractors, and there was an expected downtime of 8% to 10%, managers have seen their parts costs increase and their labor increase when they’re tied to a full-service agreement and the CPI increase. With an unbundled agreement, these fleets aren’t tied to any one parts supplier in particular, freeing up the fleet organization to shop around for the best price and availability.

Line-item visibility can make all the difference in the world in front of the leadership team. Fleet personnel should be able to address leadership and say, “here’s what we foresee happening; this is why maintenance is rising in relation to the rising CPI; this is why our tire cost is rising; this is why our fuel cost is rising; and here’s what we plan to do about it. We’re going to unbundle our leases and separate these payments to try to drive some efficiency and fuel/M&R sections. We’re going to go back and look at our programs tied to CPI and see if we should renegotiate, and we’ll look at different approaches to maintenance.’’

With this visibility, fleet operators can instill much-needed confidence in the leadership team despite the rising CPI rates and equipment supply challenges.

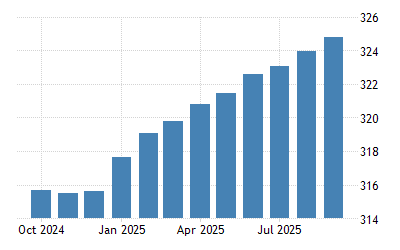

What’s more pressing for fleets locked in a FSL is the notion that few economists see the CPI rate declining significantly in the near future. Continued supply chain issues in the foreseeable future are expected to keep pressure on the cost of goods — heavy-duty trucks included — and this means these fleets won’t see any relief any time soon. And that’s a business strategy that won’t please investors and other financial stakeholders. While they are locked in their current lease agreements, fleet managers would be wise to re-evaluate their longer-term truck acquisition strategies and begin planning for the right time to convert to a more flexible, revenue-friendly unbundled lease.

(Brian Antonellis, CTP, is senior vice president of fleet operations at Fleet Advantage, a truck fleet business specializing in analytics, equipment financing and life-cycle cost management. Further information is available at www.FleetAdvantage.com.)