CPKC Challenges Trucking: The New Rail Competition in North America

Canadian Pacific Kansas City brings new competition into the North American rail industry at a time when our supply chains have never needed it more.

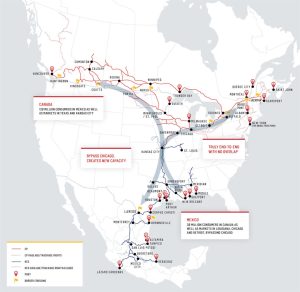

The recent merger of Canadian Pacific and Kansas City Southern (CPKC) has resulted in the creation of Canadian Pacific Kansas City, the first single-line railway connecting Canada, the United States, and Mexico. This development is set to bring new rail competition and could significantly impact the trucking industry.

Keith Creel, CPKC chief executive, stated that the merger aims to increase competition in the North American rail sector during a time when supply chains are in desperate need of improvement. By diverting 64,000 long-haul truck shipments to rail annually through new CPKC intermodal services, the company anticipates saving 300,000 tons of greenhouse gas emissions within the next five years and reducing highway maintenance costs. Furthermore, CPKC expects to lower total truck vehicle miles traveled by almost 2 billion miles over the next two decades.

Keith Creel, CPKC chief executive, said the move will “bring new competition into the North American rail industry at a time when our supply chains have never needed it more… and take trucks off public roads.”

Skepticism Over CPKC’s Truck Diversion Numbers

The merger could divert 64,000 long-haul truck shipments to rail annually, saving 300,000 tons of GHG emissions over the next five years.

Avery Vise, vice president of transportation for freight intelligence firm FTR, expressed doubts about CPKC’s truck diversion numbers. He acknowledged that the Surface Transportation Board’s claim of removing 64,000 truckloads from the road each year would have significant environmental, highway safety, and congestion benefits. However, he pointed out that the rail industry has struggled with service levels in recent years, despite improvements in 2023.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedMarket Dynamics and Intermodal Competitiveness

Vise explained that market dynamics play a crucial role in determining the competitiveness of intermodal services. He noted that intermodal transportation tends to be less competitive when trucking capacity and rates are favorable for shippers, as they are currently. This means that the CPKC merger may not have as much impact now as it will during the next upturn in trucking.

Key points of market dynamics affecting intermodal competitiveness:

- Service levels in the rail industry

- Trucking capacity and rates

- Overall economic conditions

CPKC’s first service will focus on cross-border perishable transport, potentially increasing competition in temperature-controlled intermodal shipments. (Photo courtesy of CPKC)

Temperature-Controlled Intermodal Shipments as a Near-Term Focus

One area where CPKC could potentially offer more competition in the short term is in temperature-controlled intermodal shipments. Todd Tranausky, FTR’s vice president of rail and intermodal, highlighted that CPKC’s first service offering will be cross-border perishable transport.

A Net Decrease in Truck Transportation Not Guaranteed

Vise argued that even if a significant diversion of truck traffic to intermodal occurs, a net decrease in truck transportation is not guaranteed. If the CPKC merger results in a more efficient transportation network between the U.S. and Mexico, near-shoring trends could be bolstered. This would lead to a gain in overall commerce between the two countries, potentially increasing transportation demand for both rail and trucking.

Trucking Dominance in U.S.-Mexico Trade

A more efficient transportation network between the U.S. and Mexico could bolster ongoing moves toward near-shoring, increasing overall commerce and transportation demands. (Railway Map courtesy of CPKC)

In 2020, trucking was the dominant mode of transportation in U.S. trade with Mexico, carrying 35% of freight weight. The Transportation Statistics Annual Report suggests that substantial foreign direct investment in Mexico in 2022, particularly from near-shoring U.S. companies, will likely increase cross-border trade flows. This could result in a shift of freight flows from U.S. coastal ports to the U.S.-Mexico border, with trucking maintaining its modal dominance.

Major U.S. Gateways and Freight Value

Laredo, Texas, and Detroit, Michigan, were the third and eighth largest U.S. gateways in terms of freight value in 2020. Trucks represented 22% and 36% of total freight trade in Canada and Mexico, respectively. With the CPKC merger, it is expected that these gateways will continue to play a significant role in cross-border trade.

CP-KCS Deal Overview and Future Plans

The $31 billion acquisition of KCS by CP was completed in late 2021 and approved by federal regulators on March 15, 2023. CPKC, headquartered in Calgary, Alberta, Canada, is now the only railway connecting North America and has port access on coasts around the continent.

Although remaining the smallest of the six U.S. Class 1 railroads by revenue, the new combined company operates approximately 20,000 miles of rail and employs nearly 20,000 people. Full integration of CP and KCS is expected to occur over the next three years, unlocking the benefits of the merger.

CPKC’s Infrastructure Investments and Support for Passenger Services

Market dynamics are another major factor, making rail less competitive when trucking capacity and rates are favorable for shippers.

CPKC has announced capital investments of more than $275 million over the next three years to enhance rail safety and increase the capacity of its core north-south main line between the U.S. Upper Midwest and Louisiana. These investments will not only improve the railway’s competitiveness but also contribute to the overall efficiency of the North American transportation network.

Additionally, CPKC plans to support the expansion of Amtrak and other passenger services on its network, further broadening the impact of the merger beyond freight transportation.

Conclusion: CPKC Challenges Trucking and the Future of North American Transportation

The CPKC merger brings new rail competition to the North American transportation landscape, potentially affecting the trucking industry in various ways. While skepticism exists over the extent of truck diversion to intermodal services, it is clear that the merger will have an impact on the transportation network as a whole.

In the short term, temperature-controlled intermodal shipments may see increased competition, and the long-term effects of the merger could lead to shifts in freight flows and increased efficiency in cross-border trade. As the CPKC merger unfolds and its impacts are better understood, the trucking industry, shippers, and other stakeholders will need to adapt and respond to the changing transportation landscape.

More News on This Topic:

- Explore the latest news and updates on railroad developments

- Stay informed on cross-border trade news in the North American region

- Learn more about the challenges and opportunities in the North American trucking industry

External Resources and Information: