Liquefied natural gas (LNG) is playing an increasingly important role in the global energy mix, driven by its environmentally friendly characteristics, versatility and relatively cheap price. LNG is perceived as a transition fuel that can facilitate countries’ move towards cleaner energy.

The drastic change in availability, in particular the emergence of the U.S. as a major player in the space, has been the impetus for countries to shift their business model and to form new alliances in order to achieve energy security and supply diversification.

Golden Pass LNG Terminal

The U.S. natural gas production boom has produced both commercial and strategic benefits. The abundance of natural gas offers energy security and provides the U.S. with geopolitical leverage. Energy security offers self-sufficiency and less dependence on foreign energy. In 2017, for the first time in about 60 years, the U.S. became a net natural gas exporter on an annual basis. According to an Energy Information Administration (EIA) report, net natural gas exports averaged 0.87 billion cubic feet per day (bcf/d) in 2018, more than double the average daily net exports during all of 2017 (0.34 bcf/d).

US Posed to be 3rd

The U.S. is expected to be the third largest LNG producer in the world after Australia and Qatar once all its planned projects come online. In 2018, the Sabine Pass and Cove Point terminals produced about 5 bcf/d of LNG. The EIA expects that production levels will grow to 8.9 bcf/d by the end of this year as the second wave of projects become operational.

Cheniere Sabine Pass Liquefaction Project

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedIn late 2018, Cheniere was ahead of schedule and expanded an additional train in the exiting Sabine Pass, Texas, terminal and kicked off the commissioning of its second terminal in Corpus Christi, Texas. Cameron LNG in Louisiana and Freeport in Texas are planned to follow while Elba Island in Georgia is scheduled for the end of year. Other projects including Magnolia LNG, Hackberry, Lake Charles, La., and Golden Pass are in different stages of approval and the Final Investment Decision process.

Historically, LNG market structure has relied on long-term rigid agreements with destination restriction clauses which prohibit the buyer from reselling cargoes in a secondary market to capture any arbitrage opportunity. The rigidity of destination clauses made each bilateral transaction unique and prevented LNG from becoming a homogenous competitive commodity. However, the new wave of U.S. LNG export projects is structured around a market-based model founded on flexible agreements with destination optionality provisions. This contractual framework is revolutionary because it has induced some importers to renegotiate their existing contracts and has stimulated LNG spot trading.

Freeport LNG Project

New Geo-strategic Implications

The global shift in energy supply and demand dynamics has also affected the traditional relationship between importers and exporters. Heightened environmental concerns have encouraged emerging economies such as China and South Korea to increase their LNG import volumes. Additionally, technological breakthroughs have facilitated the developments of floating storage and re-gasification units, which are cheaper substitutes for traditional capital-intensive terminals. These facilities have allowed mid-size participants such as Brazil, Argentina, Egypt and Israel to join the once-exclusive global LNG club.

This new market reality and the competitiveness of U.S. LNG exports have encouraged some political rhetoric suggesting that U.S. could potentially displace Russian gas in Europe and even in Asia. Europe relies heavily on Russian gas — especially Eastern Europe and Germany. U.S. LNG export projects are economically favorable and more competitive compared with projects in the rest of the world. U.S. brownfield LNG development projects require lower capital expenditures and are coupled with inexpensive feedstock gas.

US LNG Creating New Markets

U.S. LNG exports are creating a new playing field where the development of U.S. LNG exports is now a factor in negotiations. U.S. LNG production has a relative cost edge and its prices can act as a ceiling to the LNG price globally as well as offering increased supply diversification and energy security to importing countries.

To face the intense competition from U.S. LNG, Russia has taken a few steps to adjust its gas strategy. For example, it has introduced a hybrid formula to its traditional oil index system and is allowing its state-owned energy company Gazprom to sell LNG at unregulated prices.

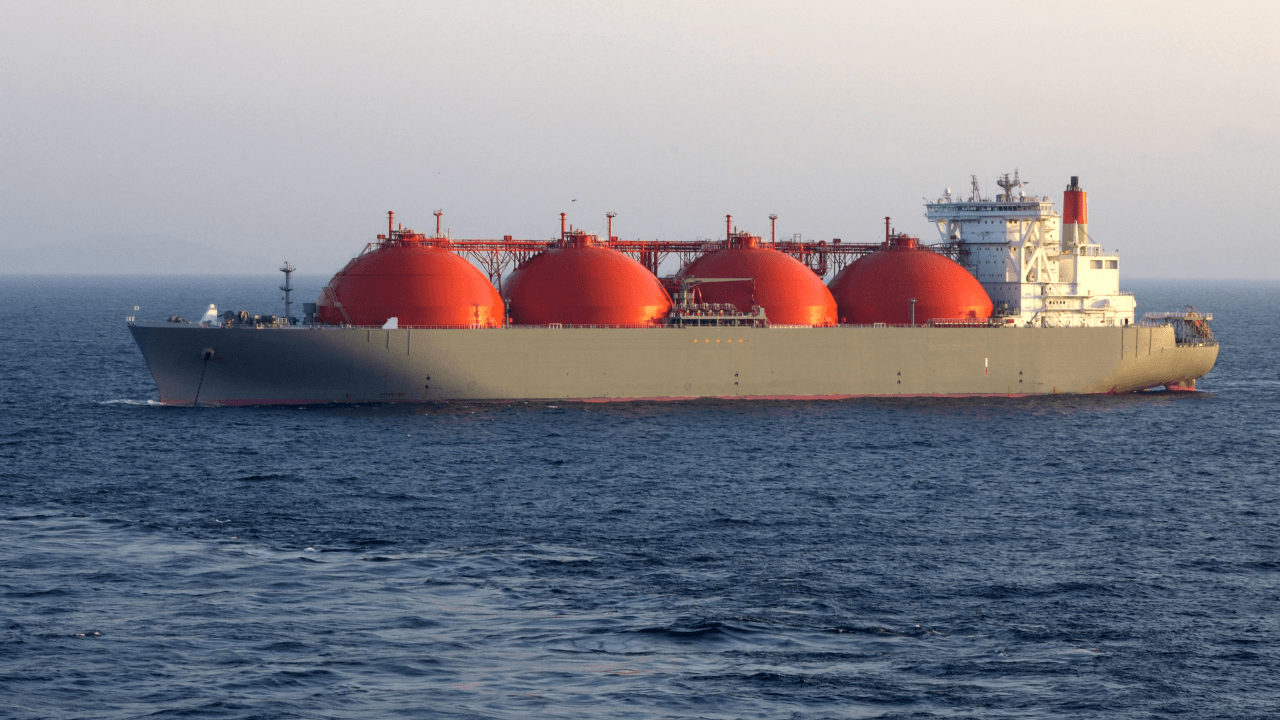

LNG Rivers, with a capacity of 135,000 cubic metres (By Pline – Own work, CC BY-SA 3.0,)

Giant LNG producers such as Qatar, Nigeria and Algeria have also felt the winds of change and mounting pressure from the U.S. and Australia, and have started to invest in new capacity.

On the Asian side, U.S. LNG faces a major challenge in China, the biggest LNG consumption market. The U.S.-China trade war has hammered trade volumes due to the retaliatory 10-percent tariff that China imposed on U.S. LNG. For example, China received only six cargoes from the U.S. from June 2018 to December 2018 compared with 25 during the same time frame in 2017.

The New Gas Order

It is remarkable how the entrance of the U.S. with one export terminal has given birth to a new market paradigm in the span of just three years. As the second wave of U.S. export projects is expected to make a big splash in the next few years, the old regime is more likely to endure more erosion – marking the development of what some have termed a “a new gas order.’’

Conclusion

The LNG market is experiencing a profound transformation driven primarily by new developments in supply and demand fundamentals. Due to the growing importance of LNG as a key fuel for the global energy mix and its implications for energy security, LNG has begun to be viewed through a geopolitical lens in a similar way to oil. While oil and LNG may have both similarities and differences, the one common factor they both share is that both are a part of international political discourse.

(from Seeking Alpha)