The market has seen this play out before: Oil tops and then rapidly drops as traders over-correct to the downside as the world appears to have more oil supply than demand. This reversed an upward trend that started in early January 2016.

With the U.S. becoming the world’s leading producer earlier this year, the WTI price is considered to be a leading benchmark for crude oil pricing. Benchmarks like WTI and Brent are used as indexes for the price of raw diesel before it is refined. Up until this year, the price of crude and carrier-fuel expense per mile moved in conjunction.

Starting in March of this year fuel expense per mile did not increase with the cost. Why is this?

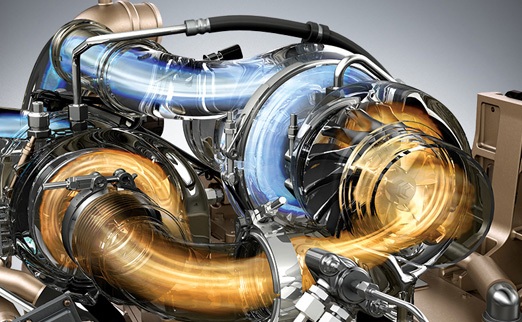

Fuel-Saving Tech

Fuel-saving technology is the primary reason for the divergence in fuel price and expense, according to a recent report by Truckloadindexes.com. Carriers have been taking advantages of tax breaks and new laws implemented this year by purchasing new equipment and revitalizing their fleets.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedIt has been widely reported that equipment manufacturers are in a backlog until sometime in 2019. These newer models have technologies that allow them to get better fuel economy but are also in better condition.

Many fleets were aging and there was little incentive to purchase new equipment until this year. High demand for trucking capacity in late 2017, which outpaced supply, fueled higher margins into the first quarter of this year. For the first time in several years, trucking companies enjoyed operating ratios in the low 90s, creating some excess cash flow. Combined with the tax break, there was never a better time to revitalize their fleets.

Razor Thin Profits

For most carriers, 2016 was a rough year. In fact, it was considered a mini freight recession. That left an abundance of older equipment heading into 2017 and 2018. With increasing revenue and demand, carriers had even more incentive to replace a lot of the older models. Many of these models were 2014 units that got lower miles per gallon.

With WTI decreasing rapidly, many will think this should only help the carrier further reduce fuel expense into the next year. While this may be true, rapid crude price decreases can sometimes be an early warning sign for global economic slowdown. Lower demand for fuel drives the price down. With the U.S. being the world’s leading producer, that means fewer dollars coming into the economy, which in turn can mean less freight moving through the networks.

WTI spot price dropped 56 percent from mid-2015 to early 2016. Because it went below the break-even point for production, many wells shut down during this period. The trickle-down effect was a slower economic growth period and a slower year for freight. With many macro-economic indicators showing signs of slowing growth, fuel expense will be at the bottom of 2019 concerns for many carriers.