U.S. Energy Information Administration (EIA) just released its 2019 Annual Energy Outlook (AEO), and it contains more than a little good news for the natural gas industry. AEO is the federal government’s official energy forecast covering production, consumption, imports, and exports of all major energy sources.

Last year EIA projected U.S. crude oil production, mostly tight oil, would exceed 11 million barrels per day by 2022 and fluctuate between 11 and 12 million barrels per day by 2050. This year EIA is forecasting that by 2020, U.S. crude oil production will exceed 13 million barrels per day, and by 2025 exceed 14 million barrels per day. It should stay above this level to 2040, EIA predicts.

Since 2010, the amount of crude produced domestically has nearly doubled (up 96 percent) and by 2025 EIA expects it will be 164 percent above the 2010 level.

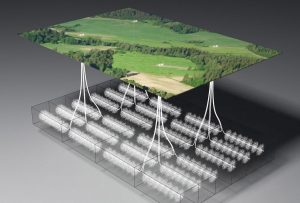

EIA AEO2019EIA 2019 Annual Energy Outlook

Natural Gas’ Healthy Growth Trend

Natural gas output is continuing its healthy growth trend, according to analysts. EIA predicts production of natural gas will grow 60 percent until 2050, from 27.2 to 43.4 trillion cubic feet, with each year exceeding the record set the year before.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed

Plentiful natural gas supplies mean that the spot price should stay below $5 per million Btu all the way out to 2050, a much lower level than forecast a few years ago.

2017 US became a Net Exporter

In 2017, the United States became a net exporter of natural gas for the first time in decades. EIA forecasts that by 2050 annual net exports should increase to a bit more than 8 trillion cubic feet. While shipments by pipeline to Canada and Mexico should increase, by the mid-2020s shipments of liquefied natural gas (LNG) by seagoing vessels should exceed pipeline deliveries.

Sometime before 2030, the U.S. will export more energy than it imports, according to the Global Energy Institute (GEI). That has not happened since the early 1950s.

Shale Revolution

The primary reason for this growth is the shale revolution, although relatively flat energy demand also gets a share of the credit, analysts said. EIA is forecasting the following trends:

– Hydrocarbons will dominate energy supplies up to 2050:

From a share of about 82 percent today, they are expected to provide 79 percent of U.S. needs in 2050. Both petroleum and coal see their shares of the energy mix decline from 38 percent to 35 percent and from 13 percent to 10 percent respectively, while natural gas sees its share increase from 30 percent to 34 percent. Non-hydro renewables (including biomass) are expected to climb from nearly 7 percent today to 12 percent in 2050.

– Oil prices will rise slower than in previous forecasts:

Many factors that go into the price of a barrel of crude oil, but the really strong numbers for U.S. production going forward will put downward pressure on prices. So while prices may rise in the future, it is likely that the rise will be more modest than it would have been without U.S. production growth. By 2050, EIA expects the price of a barrel of crude oil will be about $108. That’s about 7.5 percent less than the 2050 price EIA forecast last year.

– Energy consumption will rise modestly:

U.S. energy demand will increase about 6.5 percent between 2018 and 2050, an average of about 0.2 percent per year, according to EIA. Industrial energy use is forecast to jump 26 percent by 2050 and commercial energy use to rise 5 percent. Residential and transportation energy are both expected to decline. The use of more energy efficient technologies and an economic shift away from energy-intensive industries and towards service industries have tended to lower energy demand forecasts in recent years.

– Energy intensity will continue to improve:

Overall, the energy intensity of the U.S. economy – the amount of energy it takes to produce a dollar of GDP – will continue to decline. EIA forecasts that this measure will improve 41 percent out to 2050.

– Electricity demand will grow:

Although EIA doesn’t expect total energy demand to grow very rapidly out to 2050 (0.2 percent), it does forecast much more rapid demand growth for electricity. This marks a continuing shift in energy use away from fuels and towards electricity. EIA projects that sales of electricity will grow 0.8 percent per year to 5.2 trillion kilowatt hours in 2050 from 4 trillion kilowatt hours in 2018. That’s a total increase of 31 percent.

— Renewable sources will grow:

Renewable sources, including hydropower, are expected to account for 31 percent of our electricity generation compared to about 18 percent today. Solar is set to increase a whopping 715 percent by 2050 to account for 15 percent of our electricity.

– Average electricity prices will remain low:

Average electricity prices are anticipated to stay essentially flat from 2017 to 2050. Rates will rise fastest in the transportation sector, reflecting the increase in electricity demand for battery-powered and plug-in hybrid vehicles.

(from the Global Energy Institute)