As U.S. chemical production grows, chemical shippers and their partners refine their strategies to ensure trouble-free transportation, secure sufficient capacity, and navigate the regulatory landscape.

Thanks to an improved economy, the U.S. chemical market has been gaining strength in recent years and continues to grow.

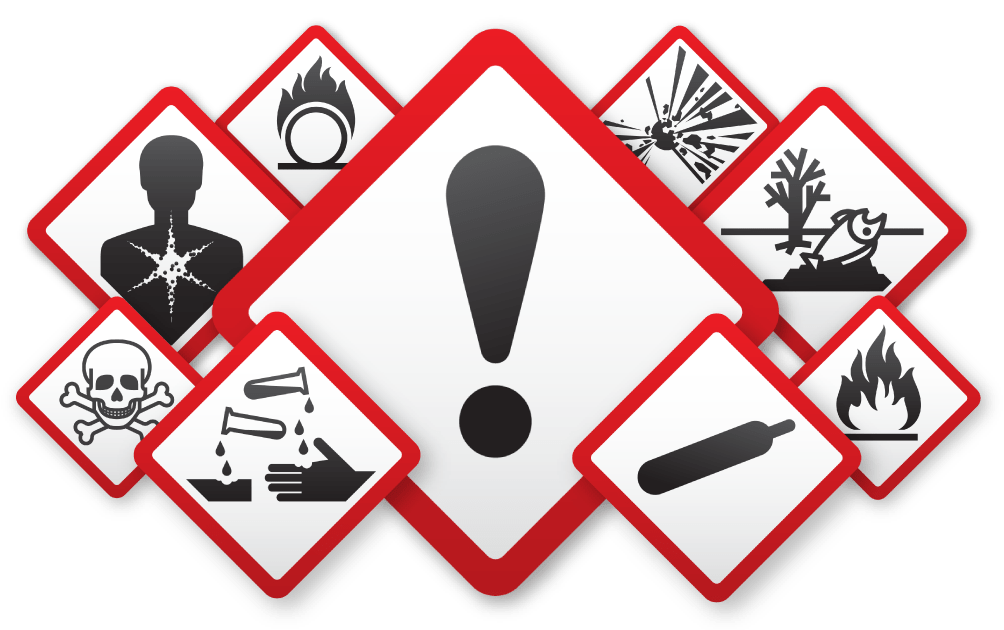

The word “chemical’’ covers a vast array of substances, including many that are sitting in kitchen cabinets. But when people talk about the challenges of chemical logistics, they’re often referring to substances that must be treated with special care. Such hazardous products include substances that might explode, ignite, emit toxic gases, corrode the skin, or otherwise cause serious harm if not handled properly.

The risk of danger is what makes chemical logistics different from most other branches of supply chain management.

Tom Voelkel, President and COO, Dupre Logistics

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed“The safety programs of the companies you’re dealing with need to be impeccable,’’ said Tom Voelkel, president and chief operating officer of Dupre Logistics of Lafayette, La. Anyone who transports or stores a hazardous chemical must thoroughly understand how to handle that product.

The consequence of any error can be grave.

SAFETY TRAINING

Because of the potential danger involved, employees at companies that move and store hazardous chemicals require special training. Some training is dictated by the U.S. Department of Transportation (DOT), which regulates how companies prepare hazardous materials (hazmat) for transit.

At Pacific Coast Warehouse Co.’s (PCWC) chemical third-party logistics distribution center in Chino, Calif., each employee takes one full day of DOT hazmat training every three years, plus an in-house course on hazard awareness, said Mark Burks, the facility’s manager.

PCWC’s chemical distribution center (DC) provides third-party warehousing services for companies that use hazardous and non-hazardous chemicals in manufacturing. PCWC also handles various finished goods chemical products for retailers, distributors, and other customers.

At distribution centers owned by chemical distributor Brenntag North America in Reading, Pa., some employees require specialized training in handling chemicals. Brenntag buys chemicals in bulk from manufacturers, then repackages them in smaller containers – ranging from 55-gallon drums to 1,000-gallon bulk tanks –for delivery to local customers, using a private fleet.

David Garner, Senior VP Operations North America, Brenntag Group

“Employees who load the trucks learn to segregate materials that aren’t supposed to come into contact with one another,’’ said David Garner, senior vice president of operations. “They also learn to affix the correct placards, indicating which hazardous materials the truck is carrying, according to the DOT’s hazmat regulations.’’

Workers who repackage chemicals take a further level of training, focused on personal protective gear. DC staff follow rules laid out by DOT and OSHA, as well as the Environmental Protection Agency (EPA), which governs cleanup in case of a spill.

BE REASONABLE

Beyond adhering to the letter of the law, many chemical distributors ensure safety by complying with the Responsible Distribution program, developed by the National Association of Chemical Distributors (NACD). This program, which is mandatory for NACD members, stipulates a series of safety measures every three years. A third-party auditor, chosen by the NACD, visits the company to make sure it’s following those procedures to the letter.

Another safety program, called Responsible Care, is mandatory for ACC members.

Glenn Riggs, Senior VP, Corporate Strategy, Odyssey Logistics and Technology

“To conduct business in the chemical industry, you need to be up to speed with the Responsible Care program,’’ said Glenn Riggs, senior vice president, corporate strategy at Odyssey Logistics and Technology (OLT) in Danbury, Conn. “Like Responsible Distribution, this program requires careful monitoring to make sure a company adheres to all of its standards.”

Another practice for companies that ship via common carrier is to vet the firms that will transport hazardous chemicals.

“About 10,000 truck suppliers are out there,’’ Riggs said. “How do you screen that huge supplier base and create a list of carriers you can rely on to deliver your chemicals across the public domain?’’

Carrier Surveys

One best practice is to conduct regular carrier surveys.

Douglas Brown, President, Brown Chemical Co

“We send carriers a form that asks questions about how they train their people. Do they keep records? Do they do background checks? How about security? What kind of training do they offer, and how often are drivers trained?” said Douglas Brown, president of Brown Chemical Co. in Oakland, N.J., and vice chairman of NACD.

If a carrier doesn’t give satisfactory answers, doesn’t have adequate insurance, or just isn’t making the right effort, Brown won’t use that company. Brown’s employees also check carriers’ safety records on federal websites.

Many safety procedures are designed to keep hazardous chemicals from spilling or leaking – events that cause enough disruption and trouble to leave a strong impression on everyone involved. PCWC is focused on safety and preventive measures.

“That’s a core reason why we continue to grow our business in the safety-conscious world of chemical storage, handling, and distribution,’’ Burks said.

Besides giving employees safety training, and implementing meticulous procedures, chemical shippers and their partners use information technology to make sure chemicals flow smoothly and safely through the supply chain.

Mike Challman, VP, North American Operations, CLX Logistics

“Having a good transportation management system (TMS) that allows us to receive rich information from our customers, provide the best information to our carriers quickly, and get updates from carriers as events happen, is a best practice,’’ said Mike Challman, vice president of North American operations at CLX Logistics in Blue Bell, Pa. “If the right information doesn’t get to the right person at the right time, that can cause big issues.’’

PROCEDURES FOR PLASTICS

Even chemicals that don’t pose safety hazards require special procedures and careful handling. Consider plastic resin – a commodity well known to Houston-based A&R Logistics. Most of A&R’s business involves dry bulk transportation, warehousing, packaging, and 3PL services for large companies that make plastic resins used in manufacturing.

In its transportation business, A&R primarily provides last-mile services. It transfers bulk loads of resins, which come in the form of pellets, from rail cars to its own tank trailers, and then moves them to consignees’ manufacturing plants.

The big concern with resin is the risk of contamination.

Mark R. Hoden, Owner, President and CEO, A&R Logistics

“All it takes to contaminate a load is a few pellets from a previous load that are a different color or a different type of chemistry,’’ said Mark Holden, A&R’s chief executive officer. “We have to be very disciplined in our material handling and trailer cleaning.’’

COMPLEX COMPLIANCE

The sheer number of government agencies that regulate chemicals turns compliance into an especially demanding job.

“We have to directly interface with nine federal agencies just to open the doors every day,’’ Brown said “Along with OSHA, the DOT and EPA, those agencies include the Food and Drug Administration (FDA), U.S. Customs and Border Protection, the Drug Enforcement Agency (DEA), the Transportation Safety Administration (TSA), and the FBI,’’ he said. State agencies regulate chemicals, too.

David Richards, VP of Regulatory Compliance, Barton Solvents

At Barton Solvents in Des Moines, Iowa, David Richards, vice president of regulatory compliance, oversees a staff of four people dedicated to fulfilling all regulatory requirements.

“But even with a staff that size, it’s difficult to do. Many companies are a lot smaller than ours, and I don’t know how they do it,’’ said Richards, who chairs NACD’s regulatory committee.

WANTED: MORE SPACE

Chemical shippers might face an abundance of regulations, but in another realm, many struggle with continual scarcity. Tight capacity, exacerbated by the ongoing driver shortage, is an issue for all kinds of shippers. But some say the problem is especially tough for companies that move chemicals.

Working for a 3PL that serves the energy market, as well as the chemical industry, Voelkel gets a firsthand look at the capacity situation for different commodities. “It’s definitely harder to find trucks for the chemical loads,’’ he said.

In part, that’s because the chemical business often involves regional trips, and many drivers these days find those long-distance hauls unattractive.

“Most professional drivers want to get home every night,’’ Voelkel said.

For bulk deliveries to customers, Brenntag operates a private fleet with 750 tractors and 1,500 tanker trailers.

“Some of those trucks are specialized,’’ Garner said “A company might need a lined tanker or a different setup involving valves.’’

In all, the fleet encompasses about 40 different types of equipment. Each of Brenntag’s drivers is qualified to handle six to 10 of those varieties, but no one driver can handle them all.

The need for specialized training reduces the pool of drivers in a market that’s already constrained.

Barton Solvents also operates its own trucking fleet. But for chemical shippers that rely on common carriers, things can get tough.

“Shippers must allow for longer lead times as they work to secure the necessary equipment,’’ Richards said.

To compound the problem, suppliers are also extending lead times, and putting tighter controls on how and when distributors can pick up their products.

“It’s a logistics nightmare trying to get all the shipments scheduled in a timely fashion,’’ Richards said.