- Electric Semi Trucks: Explore how Saia’s Tesla Semi pilot reshapes zero-emission fleets and slashes operating costs.

- Driver Feedback & Safety: Uncover first-hand accounts of smooth acceleration, plus insights on battery fire risks and prevention.

- Regulatory & Infrastructure Shifts: See how charging networks and state mandates drive heavy-duty EV adoption nationwide.

Electric Semi Trucks are evolving beyond small pilot fleets and moving toward mainstream logistics. Companies like Saia are testing new battery-powered Class 8 models in daily operations, generating crucial data on range, charging, and maintenance. Below, we detail how recent deployments, including Tesla Semi trials, influence the freight landscape—and why industry experts foresee more carriers adopting these zero-emission vehicles.

For deeper insights into the latest Tesla Semi deployments, check out this resource.

Transforming Freight with Electric Semis

Electric trucks are shifting from small pilot fleets to mainstream logistics.

The introduction of battery-powered tractors in freight has demonstrated notable benefits: smoother acceleration, reduced emissions, and lower ongoing maintenance. When it comes to operational efficiency, the ability to tackle urban deliveries and regional hauls with minimal downtime places these trucks at the forefront of innovation. Yet, the question remains whether production volumes and charging infrastructure can scale quickly to meet industry needs.

Explore more news and trends on Electric Trucks, visit this link.

LTL Carriers Testing the Waters

Saia’s recent pilot of two Tesla Semis in California underscores a growing trend among LTL providers. Drivers report steady power even on steep inclines, aligning with the promise of strong torque and lower total operating costs. While a broader rollout awaits further data, the initial findings show potential for these vehicles to become integral to daily routes. Other carriers, such as XPO and FedEx, are also conducting trials with different electric truck models to optimize last-mile delivery and reduce fleet emissions.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedLearn how LTL carriers are shaping modern freight logistics, explore this page.

Key Insights from Saia’s Pilot

- Driving Experience

Saia drivers praised the cab design and overall handling, citing quieter operation and responsive acceleration. This feedback supports the idea that electric trucks can enhance driver comfort and reduce fatigue on long stretches. - Range and Efficiency

During testing, Saia’s trucks operated at about 1.73 kWh per mile, signaling consistent energy efficiency. With carefully planned depot charging, these semis can handle local and regional tasks without straining schedules.

Addressing Challenges and Safety

- Charging Infrastructure

Building out fast-charging stations remains critical. Many fleets rely on depot-based charging for efficient turnaround times, but the broader availability of high-power chargers is needed to support larger rollouts.Read more about infrastructure challenges and solutions, check out this page. - Incident Prevention

A battery fire incident involving a Tesla-operated unit underscores potential hazards.“Though no injuries were reported, industry stakeholders emphasize the importance of well-prepared emergency response plans and thorough driver training.”

Broader Trends in Zero-Emission Freight

Saia’s Tesla Semi deployment reflects a broader push among LTL carriers toward zero-emission fleets.

Public incentives, including grants and tax credits, accelerate the shift away from diesel. Meanwhile, regulators in California and other states are setting ambitious timetables for fleet electrification. Companies like Pepsi have taken early delivery of Tesla Semis and scaled up charging infrastructure, demonstrating that large-scale deployments are possible when incentives and corporate sustainability goals align.

Discover how CARB regulations are transforming the trucking industry, learn more here.

Gaining a Competitive Edge

By piloting electric trucks now, carriers gain valuable experience in cost management, charging logistics, and maintenance protocols. As production ramps up, operators already familiar with these systems will be well-positioned to expand their electric fleets and reduce long-term operating expenses.

Delve into effective fleet management strategies, explore this link.

Future Outlook

Lower emissions, reduced maintenance, and robust torque make electric semis a game-changer for daily routes.

Improving battery technologies and charging speeds offer a promising path forward. Manufacturers continue fine-tuning range capabilities, aiming to serve longer routes and support 24/7 operations. If the industry can address ongoing questions about infrastructure, safety, and production scalability, electric trucks may soon become a standard option in freight operations nationwide.

Key Takeaways

- Real-world data from Saia’s pilot suggests electric semis can effectively handle typical LTL routes.

- Faster charging solutions and rigorous safety protocols remain top priorities.

- As more carriers adopt electric vehicles, the combined experience will lead to broader confidence and smoother logistics across the board.

Expanded Industry Insights – Costs, Infrastructure, and Regional Differences

Specific Data Points – Electric vs. Diesel Class 8 Costs and TCO

Electric trucks typically command a higher upfront price—often double or triple the cost of a comparable diesel rig. However, various incentives narrow the gap, such as the U.S. Inflation Reduction Act’s federal tax credit of up to $40,000 per qualifying truck. In California, carriers can stack additional vouchers worth $120,000 or more, dramatically lowering the purchase price.

From an operational standpoint, electric Class 8 models consume around 2 kWh per mile, costing roughly $0.24 per mile at $0.12/kWh. This translates to significant fuel savings compared to diesel’s approximate $0.50 per mile at $3.50/gal. Maintenance costs also tend to be lower—around $0.10 per mile versus $0.20 for diesel—due to fewer moving parts and less wear on brakes. Over five years of heavy-duty use, these factors can yield a 3–5 year return on investment, making total cost of ownership notably competitive with diesel, especially for high-mileage fleets.

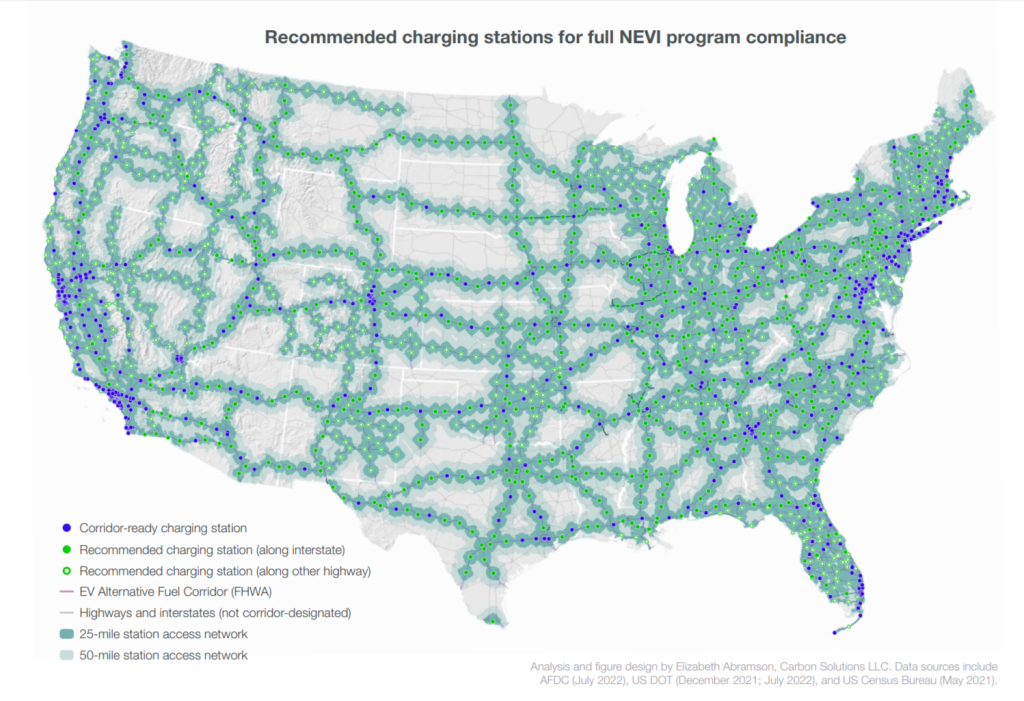

Public corridor charging—spanning from California to Washington—aims to enable coast-to-coast electric freight. Shown: 2023 United States EV Fast-Charging Corridor (source)

Infrastructure Snapshot – Public Charging Networks

While electric truck charging remains centered on private depots, large-scale public corridor projects are accelerating. In the U.S. West Coast, California, Oregon, and Washington are collaborating on a joint plan to equip Interstate 5 and adjacent freight routes with megawatt-capable chargers, enabling semis to travel from San Diego to Seattle with strategic stops. Private initiatives, such as TeraWatt Infrastructure’s I-10 Electric Corridor from Los Angeles to El Paso, reinforce this momentum by building dedicated truck-charging hubs every 150 miles.

These stations generally feature high-powered chargers (up to 1 MW or more) to replenish battery capacity within 30–45 minutes, though installation requires significant grid upgrades and funding. Federal programs, including the Charging and Fueling Infrastructure grants, help subsidize these expansions, while utility companies coordinate to ensure reliable power delivery. Over time, these corridor projects aim to support coast-to-coast electric freight routes, reducing reliance on depot-only charging.

Regional Differences in Electric Truck Adoption

Regulatory and incentive landscapes vary considerably across North America. California leads the pack with mandates like the Advanced Clean Trucks rule, requiring a growing percentage of zero-emission vehicle sales, alongside robust voucher programs. Several other states—such as New York, New Jersey, and Washington—have adopted similar rules, offering sizable rebates for Class 8 buyers. In contrast, regions like Texas rely more on federal tax credits or targeted grant programs for air quality.

With a potential return on investment in three to five years, electric Class 8 vehicles are becoming a competitive choice for high-mileage fleets.

In Canada, the federal government provides up to $200,000 CAD per heavy-duty EV purchase through iMHZEV, while provinces like Quebec and British Columbia stack additional incentives that substantially reduce acquisition costs. Quebec has also introduced sales mandates mirroring California’s. Meanwhile, Mexico is in the early stages of offering tax breaks and accelerated depreciation for electric fleets, particularly around major urban centers. Though no nationwide mandate exists, local projects and infrastructure investments around Mexico City signal growing momentum for zero-emission freight in the region.

Preparing Drivers for Electric Truck Operations

As electric truck technology matures, LTL carriers are finding that drivers benefit from specialized training to maximize the potential of these advanced vehicles. Unlike diesel tractors, which rely on geared transmissions and continuous rev management, electric motors deliver near-instant torque with minimal gear shifting or engine noise. This means new operators often face a learning curve around regenerative braking, precise throttle response, and battery monitoring. Fleet trainers emphasize the importance of understanding how route planning can impact battery range, especially given charging infrastructure constraints.

Moreover, transitioning drivers to electric trucks demands awareness of high-voltage systems and safety protocols. Pre-trip inspections must now account for battery packs, wiring integrity, and charging port functionality. Forward-thinking carriers introduce comprehensive onboarding programs, combining hands-on sessions, classroom discussions, and digital simulations that replicate electric truck handling in various conditions. Some LTL fleets also tap into manufacturer-provided resources—like Tesla’s onboard training modules—to ensure that operators fully grasp unique performance characteristics such as reduced cabin vibration and instant torque on inclines. By offering drivers the right skill set from day one, carriers not only enhance operational efficiency but also heighten driver satisfaction, reinforcing a smoother shift to zero-emission freight transport.

Conclusion

Battery advancements and infrastructure upgrades could soon make electric trucks a standard option nationwide.

Electric Semi Trucks are evolving beyond small test fleets to become a central pillar in sustainable trucking solutions. Saia’s pilot program with the Tesla Semi, alongside commitments from Pepsi and others, showcases promising developments for zero-emission fleets. Despite some challenges—from charging infrastructure to crash-related battery fires—advancements in maintenance and uptime, regulatory frameworks, and enhanced range suggest a steadily maturing market. These innovations empower LTL carriers to navigate a fast-changing freight environment, offering cleaner operations without compromising the efficiency vital to modern logistics.

Stay updated on Advanced Clean Fleets initiatives, check out this page.

Key Developments in Electric Semi Trucks

- Saia’s Tesla Semi deployment validates both power and efficiency for LTL carriers.

- Battery fire incidents spotlight the need for robust safety protocols and emergency training.

- Charging infrastructure expansions, such as depot-based megachargers, play a central role in enabling long-range operations.

- Emerging policies and incentives—federal tax credits, state grants, and CARB guidelines—are accelerating EV truck adoption across freight sectors.

Key Resources on Electric Truck Adoption & Infrastructure

- Tesla Semi – Tesla’s official Class 8 electric semi-truck page – Details the fully electric Tesla Semi truck, its specifications, range, and benefits for freight hauling.

- Freightliner eCascadia – Daimler Truck’s flagship battery-electric semi – Information on Freightliner’s zero-emission eCascadia tractor, designed for regional and short-haul routes with fast charging and advanced safety features.

- Volvo VNR Electric – Volvo Trucks’ regional-haul electric truck – Overview of Volvo’s VNR Electric, a heavy-duty truck built for local and regional distribution, highlighting its improved range, fast charging, and zero-emission performance.

- Kenworth “Driving to Zero Emissions” program – Kenworth’s official page outlining its electric truck lineup (such as the Class 8 T680E and medium-duty K270E/K370E), including vehicle capabilities, charging solutions, and fleet support for electrification.

- Nikola Tre BEV – Nikola’s battery-electric Class 8 truck – Specifications and features of Nikola Corporation’s Tre BEV, a zero-emission heavy truck aimed at metro-regional deliveries, demonstrating new industry entrants in electric trucking.

- DOE “SuperTruck Charge” Initiative (2025) – U.S. Department of Energy announcement of $68 million funding to develop and deploy high-power charging infrastructure for medium- and heavy-duty electric trucks, supporting corridor electrification near ports and freight hubs.

- National Zero-Emission Freight Corridor Strategy (2024) – Official U.S. strategy (jointly by DOE and DOT) guiding the build-out of electric truck charging (and hydrogen fueling) infrastructure along major freight corridors through 2040, with phased development of “EV freight corridors” to support long-term truck electrification.

- California HVIP – Hybrid and Zero-Emission Truck Voucher Incentive Project – California Air Resources Board program that provides point-of-sale vouchers to help fleet owners (including LTL carriers) purchase electric trucks and buses, significantly reducing upfront costs and accelerating fleet adoption of zero-emission vehicles.

- CARB Advanced Clean Trucks (ACT) regulation – California mandate requiring truck manufacturers to sell an increasing percentage of zero-emission trucks from 2024 onward. This policy drives market availability of electric trucks by targeting manufacturers and complements fleet incentive programs and upcoming fleet requirements in California.

- Canada’s iMHZEV Program – Incentives for Medium- and Heavy-Duty ZEVs – Transport Canada’s federal rebate program offering up to $200,000 (CAD) per vehicle for businesses purchasing or leasing zero-emission medium and heavy trucks. This initiative bolsters electric truck adoption in Canada, complementing U.S. efforts for cross-border fleets.

- Mexico’s EV incentives and tax benefits – Summary of Mexican federal incentives to encourage electric vehicle use (including commercial trucks), such as highway toll discounts, exemption from new vehicle taxes, and accelerated depreciation for EV investments. These measures support cleaner freight transport within Mexico and across North American borders.