- Benore hydrogen trucks slash 400 t CO₂ per rig each year—discover the game‑plan behind this zero‑emission leap.

- New Savannah hydrogen hub fuels 14 Hyundai XCIENT Class 8 units in just 20 minutes—see how the hydrogen fuel‑cell trucks strategy scales.

- Find out why this zero‑emission logistics model could rewrite freight economics across the Southeast by 2030.

Benore Hydrogen Trucks Fuel a Sustainable Logistics Future

Fourteen Hyundai XCIENT tractors show zero‑emission freight is road‑ready.

Benore hydrogen trucks entered the market in 2022 with a four‑truck pilot. Two years on, the fleet has expanded to 10 new Hyundai XCIENT Class 8 units—bringing the total to 14—and operates up to 450 miles per fill, delivering inbound parts and outbound EVs for Hyundai. Each truck eliminates roughly 400 metric tons of CO₂ annually, cutting local air pollutants and positioning Benore as a regional leader in zero‑emission logistics. For the most recent developments and company announcements, explore our latest Benore Logistics coverage.

How Do Benore Hydrogen Trucks Fit Into U.S. Freight?

Benore hydrogen trucks bridge a critical gap between short‑range battery‑electric vehicles and long‑haul diesel tractors. Fast refueling (≈20 minutes) and high payload capacity make them ideal for just‑in‑time automotive supply chains. Georgia’s growing hydrogen infrastructure, anchored by the HTWO Energy Savannah station, ensures fleet uptime and cost stability even as national fueling networks mature. To see how other operators optimize uptime and payload, review our insights on fleet‑management best practices.

Benore Hydrogen Trucks and Hyundai Partnership Explained

“These hydrogen fuel‑cell trucks represent a significant step forward for Benore and our ability to deliver innovative, sustainable logistics solutions.” — Dennis Kunz, Vice President, Revenue Strategy & Operation Development

Hydrogen trucks bridge the range gap between batteries and diesel.

Benore hydrogen trucks operate through a three‑party alliance:

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed

- HTWO Logistics—a Hyundai‑Glovis joint venture—owns the trucks and oversees fueling contracts.

- Hyundai Motor Group supplies the XCIENT chassis, each powered by dual 90 kW fuel‑cell stacks and 68 kg of onboard hydrogen.

- Benore Logistic Systems dispatches, maintains, and drives the fleet, guaranteeing just‑in‑sequence deliveries to Hyundai Metaplant America.

Discover other collaborations reshaping logistics by exploring our stories on strategic logistics partnerships.

“We are thrilled to welcome Benore Logistic Systems as a partner. Their commitment to advancing sustainability in logistics sets a strong example for the industry.” — Jonathan Choi, CEO, HTWO Logistics

Building Infrastructure: Benore Hydrogen Trucks in Savannah

Savannah’s new hub refuels Class 8 fuel‑cell trucks in under 20 minutes.

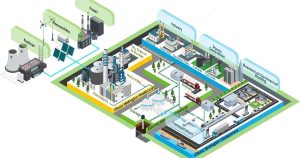

A $30 million HTWO Energy Savannah facility will open in late 2025, producing 1.2 t/day of green hydrogen via modular steam‑methane reformers coupled with renewable natural‑gas offsets. Initial throughput supports 14 trucks but scales to 50 units—matching Benore’s five‑year growth plan. Dual‑purpose EV fast‑chargers on‑site will serve Benore’s eight battery‑electric tractors, creating a hybrid clean‑energy hub near the Port of Savannah. Stay current on fueling corridors and production hubs through our section on hydrogen infrastructure developments.

Hydrogen Supply Chain — Savannah Clean‑Energy Hub

| Element | Phase 1 (late 2025) | Scalable Target |

|---|---|---|

| Facility | HTWO Energy Savannah — 10 mi from port | Same site |

| Cap‑ex | >$30 M initial | + $25 M Phase 2 |

| On‑site H₂ output | 1,200 kg day‑¹ (RNG‑blend SMR) | Up to 4,200 kg day‑¹ |

| Third‑party investment | $33 M HydroFleet plant (7–14 trucks day‑¹) | Expandable to 50 trucks day‑¹ + electrolyzer & EV DC‑FC |

Guaranteed local production and < 20‑minute fast fills underpin Benore’s ability to keep its hydrogen fleet on strict just‑in‑time schedules.

Financial Snapshot: Costs & ROI of Benore Hydrogen Trucks

- CapEx per truck: ≈ $350 k (fuel‑cell warranty included).

- Fuel cost parity: Projected at $6.50–$7.00/kg H₂ by 2026, achieving diesel‑equivalent $/mi for regional routes.

- Incentives: Georgia’s Clean Freight Tax Credit (up to $40 k per zero‑emission truck) and federal 45V PTC for hydrogen production lower TCO.

- ROI horizon: 5–7 years at 85,000 mi/yr, assuming $50/ton social cost of carbon.

If you’re calculating ROI on low‑carbon assets, dive into our archive of fleet electrification economics.

Cost Snapshot — TCO at a Glance

| Metric | Hyundai XCIENT FCEV | Comparable Diesel 6×4 |

|---|---|---|

| Eligible purchase incentive | Up to $40 k federal credit | None |

| Additional state incentive | $240 k CA HVIP (example) | N/A |

| Annual fuel use (85 k mi) | 12,300 kg H₂ | 13,100 gal diesel |

| Fuel‑cost parity band | $5–$6.5 kg H₂ | $4 gal diesel baseline |

| Illustrative annual fuel spend | $80 k (H₂ @ $6.50 kg) | $52 k (diesel @ $4 gal) |

With hydrogen near $6 kg and available credits, Benore’s duty cycle approaches seven‑year diesel parity, before lower maintenance or carbon‑credit revenue are factored in.

Regulatory Landscape Shaping Benore Hydrogen Trucks

Clean‑fuel corridors will soon extend to Atlanta, Charleston, and Jacksonville.

Georgia’s participation in the Southeast Hydrogen Hub (H2Southeast) and alignment with the EPA’s Clean Trucks Plan tighten NOx and GHG ceilings for Class 8 operators. Benore hydrogen trucks future‑proof the fleet against 2030 Phase 3 standards while qualifying for alternative‑fuel weight allowances that expand payload by 2,000 lb.

Regulatory Outlook Timeline — U.S. Heavy‑Duty GHG Phase 3

| Year | Federal Action | Operational Impact |

|---|---|---|

| 2027 MY | Revised Phase 3 CO₂ limits begin for most HD segments | Early compliance benefit for Benore’s zero‑tailpipe fleet |

| 2030 MY | Stronger tractor targets proposed | Supports the residual value of existing FCEVs |

| 2035 MY | EPA evaluating ≥60 % CO₂ drop | Positions hydrogen as a long‑haul compliance hedge |

Voice Query: Are Benore Hydrogen Trucks Available Beyond Georgia?

Benore hydrogen trucks currently serve routes within 250 miles of Savannah, but HTWO Logistics confirms preliminary site vetting for Atlanta, Charleston, and Jacksonville corridors—expanding coverage to three states by 2027.

Voice Query: What Range Do Benore Hydrogen Trucks Achieve?

Fourth‑generation Hyundai XCIENT fuel‑cell tractors in Benore’s fleet achieve real‑world ranges of 400–450 mi per 68 kg fill, depending on terrain, payload, and HVAC usage.

Operational Highlights at a Glance

| Metric (2025) | Benore Hydrogen Trucks | Battery‑Electric Trucks | Diesel Baseline |

|---|---|---|---|

| Fleet Size | 14 | 8 | 650 |

| Range (mi) | 400–450 | 150–200 | 800+ |

| Refuel/Charge Time | 20 min | 90–120 min | 15 min |

| Tank‑to‑Wheel CO₂ | 0 g | 0 g | 1,500 g/mi |

| NOx Emissions | 0 | 0 | 12 g/mi |

Compare specs and trends across the sector by visiting our Class 8 truck market insights page.

Market Context: Hydrogen Fuel‑Cell Trucks in the U.S.

On‑site production of 1.2 tons of green hydrogen daily safeguards uptime.

Benore hydrogen trucks are part of a cautious but accelerating nationwide rollout:

- Werner Enterprises added two Cummins‑powered FCEVs in California, targeting a 55 % CO₂ cut by 2035.

- DHL Supply Chain began Illinois drayage with Nikola Tre FCEVs, projecting 80 % emissions savings.

- Hyzon Motors announced liquidation in December 2024, and Nikola Corporation filed for Chapter 11 in February 2025, highlighting capital challenges for startups.

- Toyota and Daimler Truck North America advance fuel‑cell prototypes, with commercial models due post‑2026.

Benore’s success underlines the advantage established carriers and OEMs hold in scaling hydrogen operations.

Environmental Impact

Independent lifecycle analysis reveals that each Benore hydrogen truck:

- Avoids ~400 t CO₂‑eq annually versus diesel, equivalent to removing 88 passenger cars from the road.

- Cuts ~12 kg NOx and ~350 g PM2.5 per 100,000 mi, improving air quality in port communities.

- Operates on hydrogen that can reach <2 kg CO₂‑eq/kg well‑to‑wheel when sourced from renewable natural‑gas blends, meeting DOE 2030 “clean hydrogen” targets.

Broader industry data on emissions reduction is available under zero‑emission freight trends.

Technology Overview

Fuel‑Cell System

Hydrogen rigs slash 400 tons of CO₂ per truck each year.

Dual 90 kW PEM stacks (Ballard‑licensed) feed a 350 kW e‑axle. Regenerative braking and a 72 kWh buffer battery smooth transients. For engineering updates on power stacks and components, check out the latest fuel‑cell technology news.

Storage

Five Type IV 700 bar tanks store 68 kg H₂. Advanced composites reduce weight by 12 % versus 2023 models.

Safety

Redundant leak detection, automatic isolation valves, and crash‑tested enclosures comply with SAE J2579.

Maintenance

Fuel‑cell stack overhaul interval: 30,000 h; motor and inverter interval: 600,000 mi; projected uptime: 95 %+.

Reliability Scorecard — Proven Field Data

- First 48 XCIENT FCEVs in Switzerland surpassed 10 million km of service without major safety failures.

- Dual 90 kW stacks are rated for >30,000 h before overhaul, supporting fleet uptimes above 95 %.

- Benore’s U.S. units share the same powertrain architecture, de‑risking early adoption for American fleets.

Competitive Advantages & Challenges

Strengths

- High payload versus BEV rivals

- Rapid refueling enabling multi‑shift utilization

- Supportive state incentives and growing hydrogen hubs

Weaknesses

- Higher sticker price until production volumes rise

- Limited public fueling beyond project corridors

Opportunities

- Expansion into the Southeast automotive belt (Georgia‑Tennessee‑Alabama)

- Integration with green‑hydrogen credit trading under IRA 45V

Threats

- Volatile hydrogen commodity prices tied to natural‑gas markets

- Uncertain long‑term federal policy if political winds shift

Workforce & Reliability Insights

Transitioning from diesel to hydrogen demands more than hardware—it requires a trained workforce fluent in high‑pressure H₂ safety protocols, fuel‑cell diagnostics, and electric‑drive maintenance. Benore partnered with the Technical College System of Georgia to create a 40‑hour certification program covering hydrogen leak detection, emergency venting, and stack electrical isolation. Drivers complete a 12‑hour module on H₂ fueling procedures—including pre‑trip leak checks and emergency‑shut‑off drills—followed by supervised fills at the Savannah hub.

Early operational data affirm that the human‑factor investment is paying dividends. Benore reports mean‑time‑between‑service (MTBS) intervals of 9,800 miles for its Hyundai XCIENT FCEVs—comparable to new diesel tractors and notably higher than first‑generation battery‑electric trucks requiring frequent software patches. Crucially, no unplanned roadside events have occurred since the hydrogen rollout began in 2022. Fleet telematics show stack voltage degradation of less than 2 % after 18 months of duty cycles averaging 270 miles a day, reinforcing OEM claims of 30,000‑hour durability.

Benore’s VP of Maintenance, Lisa Harrington, sums up the results:

“With trained techs and real‑time diagnostics, our hydrogen uptime is rivaling diesel—and the drivers appreciate the quiet cab and zero fumes.”

The takeaway for fleets eyeing fuel‑cell adoption is clear: pair capital investment with targeted workforce training and robust telematics, and hydrogen reliability can match or surpass conventional powertrains.

Strategic Roadmap: 2025–2030

- 2025: Commission Savannah station; integrate telematics for fuel‑cell health monitoring.

- 2026: Expand Benore hydrogen trucks to 25 units; add Atlanta refueler.

- 2027: Launch Charleston and Jacksonville corridors; explore fuel‑cell refrigerated trailers.

- 2028: Participate in Southeast Hydrogen Hub shared‑fuel program to stabilize H₂ pricing.

- 2029: Deploy hydrogen hybrid microgrids at Benore terminals for on‑site generation.

- 2030: Target 40 % of Benore tractor fleet operating on hydrogen or battery power.

Frequently Asked Voice‑Search Questions

Q: “Who supplies the fuel for Benore hydrogen trucks?”

A: HTWO Logistics partners with HydroFleet to produce and dispense green hydrogen at the Savannah hub.

Q: “How clean is the hydrogen used by Benore hydrogen trucks?”

A: Initial fuel is RNG‑offset grey hydrogen (<4 kg CO₂‑eq/kg); phase‑two electrolyzers will lower carbon intensity to <2 kg CO₂‑eq/kg by 2027.

Q: “What is the total cost of ownership for Benore hydrogen trucks?”

A: With incentives, projected TCO equals diesel parity at ~7 years of service and 700,000 mi, driven by lower fuel consumption and maintenance.

Conclusion

Benore hydrogen trucks stand at the forefront of U.S. zero‑emission freight. Their successful deployment showcases how established carriers, OEMs, and logistics partners can collaborate to decarbonize heavy haulage—proving that clean transportation is not a distant vision but an operational reality today. Finally, learn how carriers align environmental goals with profitability in our sustainability initiatives in the trucking section.

Key Developments: Benore Hydrogen Trucks 2025

- Fleet expanded to 14 Hyundai XCIENT fuel‑cell tractors, each with 400–450 miles of real‑world range.

- HTWO Logistics partnership funds a $30 M Savannah station producing 1.2 tons of hydrogen per day, scalable to 50 trucks.

- Combined incentives (Georgia tax credits, federal 45V) trim TCO, targeting diesel cost parity within seven years.

- The infrastructure roadmap calls for additional hubs in Atlanta, Charleston, and Jacksonville by 2027.

- Environmental impact: ~5,600 t CO₂ avoided annually, plus zero NOx and PM2.5 on Benore’s Savannah routes.

Essential External Resources on Hydrogen Class 8 Fleets

- EPA Phase 3 Heavy‑Duty GHG Final Rule (2024) – official regulation setting 2027‑2035 CO₂ limits for trucks.

- Hyundai press release: next‑gen XCIENT fuel‑cell truck at ACT Expo 2025 – specs, range, and U.S. rollout details.

- HTWO Energy Savannah announcement – plans for the first Class 8 hydrogen refueling & EV fast‑charge hub near Savannah, GA.

- HydroFleet statement on Savannah hydrogen station partnership – construction timeline and daily production capacity.

- Benore Logistics sustainability page – fleet overview of 14 Hyundai XCIENT hydrogen trucks in service.

- DOE Alternative Fuels Data Center: Commercial Clean Vehicle Tax Credit – summary of incentives under IRC 45W.

- IRS Form 8936 instructions – claiming credits for new fuel‑cell and electric commercial vehicles.

- Cummins & Werner Enterprises fuel‑cell truck pilot release – validation program for Accelera hydrogen powertrains.