- Del Monte Foods Chapter 11 moves fast: $912.5M DIP (including $165M new cash) keeps plants and deliveries running while a court‑supervised sale and bidding procedures advance.

- Freight exposure in focus: Transplace/Uber Freight (~$9M), ES3 (~$4M), Saddle Creek ($1.35M), and CHEP (~$470K) are among 10k+ unsecured creditors — their recovery hinges on sale proceeds.

- Timeline to watch for creditors and carriers: Unsecured creditors’ committee formed July 17; Aug 12 hearing on final DIP financing and bidding procedures; §341 meeting set for Aug 28.

Court‑supervised sale process advances while production and deliveries continue without interruption. (Photo: Ken Hammond/USDA (Public Domain))

As cans of Del Monte fruit cocktail sit on a store shelf. The 139-year-old company filed for Chapter 11 to facilitate a sale process while continuing operations.

Del Monte Foods’ Chapter 11 bankruptcy – one of the largest food industry bankruptcies in recent years – is sending shockwaves through supply chains and creditors. The 139-year-old canned foods company filed for Chapter 11 protection on July 1, 2025, in the District of New Jersey (Case No. 25-16984, before Judge Michael B. Kaplan), listing over $1 billion in liabilities and more than 10,000 creditors. This major Del Monte Foods bankruptcy is part of a court-supervised restructuring aimed at finding a buyer for the business and shedding a heavy debt load. As the company seeks to stabilize, logistics providers, suppliers, and investors are closely watching how the Chapter 11 sale process unfolds, given its far-reaching supply chain impact.

For more news and updates on bankruptcy filings affecting the industry, see our Bankruptcy coverage.

Overview of Del Monte Foods’ Chapter 11 Filing

Del Monte Foods Corporation (based in Walnut Creek, California) voluntarily filed for Chapter 11 in the U.S. Bankruptcy Court for the District of New Jersey on July 1, 2025. The filing was backed by a restructuring support agreement (RSA) with a group of the company’s lenders, signaling a pre-arranged plan to sell all or substantially all assets as a going concern. According to court documents, the company reported over $1 billion in assets and liabilities, placing this case among the largest food-shipper bankruptcies by scale.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay Informed(Del Monte Foods is well known for its flagship Del Monte-branded canned fruits and vegetables, as well as other brands like Contadina tomato products, College Inn broths, Joyba teas, Kitchen Basics stocks, and more, with U.S. sales of $1.7 billion in 2024. Notably, Del Monte Foods is separate from Fresh Del Monte Produce, the fresh produce company – the Chapter 11 filing does not involve Fresh Del Monte, which operates independently.)

Under Chapter 11, Del Monte Foods aims to restructure its balance sheet and facilitate a value-maximizing sale. The company secured $912.5 million in debtor-in-possession (DIP) financing to fund operations during the process. This financing is split between a term loan and an asset-based lending facility, led by Wilmington Savings Fund Society and JPMorgan Chase. It includes $165 million in new funding from existing lenders and was approved by the court, ensuring Del Monte has sufficient liquidity to continue operating normally throughout the bankruptcy.

Management emphasized that the company’s summer production “pack” season for canned goods is proceeding uninterrupted thanks to the DIP funding. The court also approved first-day motions allowing Del Monte to pay employees, honor customer programs, and otherwise conduct business as usual. Del Monte Foods will continue operating and serving customers during Chapter 11, using the DIP loan to keep its supply chain running with minimal disruption.

Crucially, the Chapter 11 sale process is central to Del Monte’s turnaround plan. Company leadership determined that a court-supervised sale of the business (in whole or substantial parts) is the most effective path to address its debts and position the brands for long-term success. “After a thorough evaluation of all available options, we determined a court-supervised sale process is the most effective way to accelerate our turnaround and create a stronger and enduring Del Monte Foods,” said CEO Greg Longstreet. The bankruptcy filing and RSA authorize the board to solicit purchase offers via an auction.

A group of the firm’s secured lenders is poised to act as a “stalking horse” bidder (using a credit bid of their debt) to set a baseline price, while the company is also adjusting auction rules to attract other bids in order to maximize value. If a qualified strategic buyer or private equity investor emerges with a higher offer, the lenders would be paid off; otherwise, the lender group could take ownership of the company in exchange for the debt. The goal is to complete the auction and have a sale approved within a few months (potentially by late 2025), providing new ownership and an improved capital structure for the storied food company.

In the near term, the court scheduled an omnibus hearing for August 12, 2025, to consider final approval of the DIP financing and bidding procedures, and the initial §341 meeting of creditors is set for August 28, 2025 (where creditors can question the company’s representatives).

For additional insights into the challenges facing companies under Chapter 11, browse our Chapter 11 hub.

Unsecured creditors’ recoveries hinge on sale results and available proceeds after senior claims.

It’s worth noting that Del Monte’s international affiliates are mostly unaffected by this U.S. proceeding. The Chapter 11 case covers the U.S. subsidiary group of Del Monte Pacific Limited (DMPL), the Singapore-listed parent of Del Monte Foods. DMPL chose to withdraw financial support for its struggling U.S. unit ahead of the filing, effectively handing control to Del Monte’s lenders. As a result, the lender group now holds a 25% equity stake in Del Monte Foods and controls a majority of board seats during the bankruptcy.

The parent DMPL and its profitable Asian and Latin American operations remain solvent and continue operating normally (for example, Del Monte’s Philippines subsidiary remains stable and is not in bankruptcy). However, DMPL expects to deconsolidate the U.S. unit and write off significant investments tied to it – as of end-January 2025, the parent had a U.S. $579 million net investment and U.S. $169 million in intercompany receivables tied up in Del Monte’s U.S. business.

Those values will likely be largely lost or impaired due to the bankruptcy, creating a capital deficit on the parent’s balance sheet. (Indeed, industry reports suggest DMPL is exploring measures like asset sales or listing its Philippine subsidiary to help recoup these losses.) Despite these financial hits, DMPL’s management stressed that its core overseas businesses (which account for roughly half of global revenue) are healthy and not dragged down by the U.S. debt.

Supply Chain Ripple Effects of Del Monte Foods’ Chapter 11

The Del Monte Foods Chapter 11 is having ripple effects across the supply chain, particularly in the transportation and logistics sector. As a primary food shipper with a nationwide footprint, Del Monte depends on a network of carriers, warehouses, and service providers – many of whom are now caught as unsecured creditors in the bankruptcy. The initial Chapter 11 petition indicated that over 10,000 creditors are affected, ranging from packaging suppliers and farmers to marketing agencies. Among these are several significant logistics and transportation providers for which Del Monte owes money for pre-bankruptcy services. Those providers now face delayed or reduced payment, highlighting how a big shipper bankruptcy can cascade into challenges for freight and warehousing partners.

To learn about factors influencing food transportation across the sector, food transportation stories.

Logistics Providers Owed Millions by Del Monte Foods

Transplace/Uber Freight, ES3, Saddle Creek, and CHEP appear among the largest logistics creditors.

Several logistics companies are prominently listed among Del Monte’s largest unsecured creditors, collectively owed millions of dollars. For example, Uber Freight (via its Transplace unit) is owed about $9.1 million for transportation management and brokerage services provided before the bankruptcy – reportedly making Uber Freight the second-largest unsecured trade creditor in this case. For updates on Transplace and its role in freight management, follow this link.

Saddle Creek Logistics Services, a Florida-based warehousing and trucking provider (with ~400 power units in its fleet), has about a $1.35 million unsecured claim for services it provided to Del Monte. Another key partner, ES3 (a New Hampshire–based warehousing and distribution company), is owed roughly $4.0 million, and pallet pooling provider CHEP USA is owed about $470,000.

Additionally, industry credit reports show Steuben Foods Inc. (a New York-based food processing supplier) with a claim of approximately $6.98 million, highlighting that even some co-packers and suppliers have significant exposure. For context, the single largest unsecured trade creditor appears to be Seneca Foods, owed nearly $19.9 million (perhaps reflecting a co-packing or supply relationship), and other food suppliers like Reser’s Fine Foods are also listed among major creditors. These outstanding debts illustrate the breadth of Del Monte’s supply chain – covering freight brokerage, trucking, warehousing, packaging, and ingredients – now caught up in the bankruptcy process.

Because these obligations were incurred before the Chapter 11 filing (“pre-petition” balances), they are categorized as unsecured claims in the court case. Unsecured creditors do not have collateral backing their claims, so legally they stand behind secured creditors (banks and lenders with collateral) and specific priority claims in bankruptcy. In practical terms, this means recovery for these logistics providers is uncertain – they will likely receive less than the full amount owed, and payment will be delayed until a reorganization plan or asset sale is completed.

There is no guarantee of full recovery for unsecured creditors; outcomes depend on how much value the company’s asset sale generates and how the bankruptcy court allocates those proceeds. For instance, if Del Monte Foods is sold for a high enough price to cover all senior secured debts, unsecured trade creditors could potentially see their claims paid in full. But if the sale proceeds only suffice to pay secured lenders, unsecured creditors might end up with only a few cents on the dollar (or potentially nothing). This inherent risk has left many Del Monte vendors facing a possible write-off of the debt.

From the perspective of these logistics firms, the potential losses are significant. However, some are cushioned by their own size and diversification. Saddle Creek Logistics, for example, had $922 million in gross revenue in 2024, so a $1.3 million hit, while unwelcome, is not catastrophic to its overall business. “We have other revenue streams that provide a cushion,” one might reason, noting the company’s scale. (Saddle Creek did not publicly comment on the bankruptcy situation.)

Similarly, Uber Freight is a large operation backed by Uber; a $9 million unpaid receivable, though large, is likely manageable within its broader balance sheet. Smaller vendors like CHEP (in the context of Del Monte’s account) or specialized suppliers could feel the pinch more acutely. Unsecured creditors in this case must line up behind $912.5 million in DIP financing and other senior debts, meaning they may recover only a fraction of what they’re owed if the asset sale proceeds are limited. In a court-supervised process, these trade creditors may have to wait many months to find out their ultimate payout.

Notably, the unsecured trade creditors have organized to have a voice in the proceedings – the U.S. Trustee appointed an official committee of unsecured creditors on July 17, 2025, to represent the interests of this large creditor group. This committee can hire attorneys and negotiate on behalf of trade creditors as the case progresses. While it doesn’t guarantee a better recovery, it gives suppliers and carriers a seat at the table (through committee representatives) in plan negotiations or asset sale discussions.

To dive deeper into issues surrounding unsecured creditors in major bankruptcies, read more on Unsecured Creditors.

There is one silver lining for current partners: Del Monte’s logistics providers have the opportunity to continue doing business during the Chapter 11 on a cash-paid or priority basis. Under U.S. bankruptcy law, post-petition services (those provided after the July 1 filing) are treated as administrative expenses, which generally have priority for payment. Del Monte Foods has indicated it will rely on many of its freight and warehousing providers to keep goods moving through the restructuring.

Parent DMPL expects to deconsolidate the U.S. unit and record substantial write‑downs.

In fact, major carriers and brokers have continued hauling for Del Monte since the filing, since the company secured DIP financing to pay for new shipments. These post-filing charges are budgeted and expected to be paid in full as regular operating expenses, as long as the court approves and the company stays within its financing budget.

Uber Freight, for one, expressed confidence about ongoing business with Del Monte – a company representative stated that Uber remains a “critical” logistics partner and expects to receive full payment for all services provided after the bankruptcy filing. “We remain committed to supporting [Del Monte] through this court-supervised restructuring… As a critical vendor of Del Monte, we are confident we will receive full payment for services rendered, and we remain focused on delivering uninterrupted support,” the Uber Freight spokesperson said. Stay informed on the latest news regarding Uber Freight, our Uber Freight feed.

This reflects a familiar dynamic in Chapter 11 cases: vendors may incur a loss on old debt, but if they continue supplying the debtor (often under tightened credit terms, like cash on delivery or shorter payment cycles), they can at least maintain the relationship and have new transactions protected as administrative claims. The court still has to approve any special treatment (Del Monte did file a motion to pay certain critical vendors some pre-petition amounts to ensure the supply of essential goods). Still, given Del Monte’s reliance on logistics to distribute its products, it’s likely that continuing carriers and warehouses will be paid for post-petition work in the ordinary course.

Freight Market Challenges Amplify the Impact

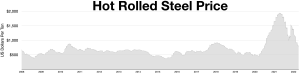

The impact on transportation creditors comes at an already challenging time in the freight and trucking markets. Freight demand in 2025 has been relatively soft, and the industry is grappling with headwinds like volatile fuel costs and trade uncertainties (for example, a new 35% U.S. tariff on imported tinplate steel used for food cans has increased input costs).

Stay abreast of the latest developments shaping the freight industry, freight industry updates.

Lender group’s stalking‑horse credit bid establishes the floor as auction rules widen. (Library of Congress – Clarkson S. Fisher Federal Building & U.S. Courthouse (Trenton))

Trucking capacity has been abundant, and rates have been under pressure, creating a prolonged “freight recession” scenario for many carriers.

For more insights into changes within the trucking industry, trucking industry coverage.

In such an environment, losing payments on a major customer account can further squeeze already thin margins.

For instance, a mid-sized carrier or 3PL might have been counting on Del Monte freight revenue to cover fixed costs; if a portion of that revenue becomes uncollectible due to the bankruptcy, it is effectively a sudden loss that hits the bottom line. Industry analysts note that the timing is tricky – many logistics firms have been struggling with overcapacity and depressed spot rates for over a year. “There’s still too many trucks for the available loads, so any hit to a carrier’s cash flow makes a difficult situation worse,” one freight market expert observed.

Moreover, the Del Monte case underlines the credit risk that suppliers face when dealing with financially distressed shippers. Unsecured trade creditors often have little recourse in a bankruptcy aside from hoping for eventual payout from whatever value is recovered. This has prompted some trucking and warehousing companies to tighten their credit policies – for example, by monitoring customers’ financial health more closely and requiring shorter payment terms or advance payment if a client shows signs of trouble.

The ripple effect of Del Monte’s bankruptcy on the broader supply chain is a reminder that freight companies must manage customer credit exposure carefully. If the Chapter 11 sale process succeeds and Del Monte emerges under new ownership, logistics providers may eventually benefit from a healthier customer in the long run. But in the short term, those owed money must be prepared for possible losses. As one trade-creditor attorney commented, “When a big shipper goes bankrupt, it’s the unsecured vendors – often suppliers and carriers – who end up holding the bag,” at least until they see what recovery the bankruptcy yields.

Despite these challenges, many in the industry are continuing to work with Del Monte Foods through its restructuring, essentially betting on the company’s successful turnaround. Del Monte’s iconic brands and steady baseline demand (canned fruits, vegetables, and other pantry staples) mean that freight volumes are still moving. Logistics providers are in a transitional position – they play a vital role in keeping Del Monte’s supply chain running, even as they navigate uncertainty about those unpaid pre-petition bills.

Some have likely tightened credit terms (for example, moving to cash-before-delivery or immediate invoicing for any new loads) to limit further exposure. Others, especially larger brokers like Uber Freight, seem committed to the partnership, presumably because Del Monte’s ongoing business (and future potential under new owners) is valuable enough to justify the short-term risk.

In the big picture, the freight industry remains resilient but cautious amid such bankruptcies. The Del Monte case, along with other recent high-profile bankruptcies in 2024–2025, is prompting carriers and 3PLs to be more vigilant about shipper solvency and creditworthiness. It’s an unusual convergence of a legacy food company’s bankruptcy and a weak freight market – a combination that amplifies stress on the logistics sector, and one that many hope will be temporary as the market eventually rebalances.

Stay updated on the latest trends and ripple effects across the supply chain, explore our Supply Chain reporting.

Del Monte’s Restructuring Plan: DIP Financing and Sale Process

Key dates: August 12 final DIP hearing; August 28 §341 creditors’ meeting. (The Clarkson S. Fisher Federal Building & U.S. Courthouse. Exterior details.)

To navigate the Chapter 11 process, Del Monte Foods has laid out a comprehensive restructuring plan centered on selling the company and supported by robust financing. A cornerstone of this plan is the DIP financing: the company obtained a debtor-in-possession loan of $912.5 million from its existing lenders. The DIP facility is split between a term loan and an asset-based revolving credit line, led by Wilmington Savings Fund Society (as agent) and JPMorgan Chase.

The DIP funds (which have first-priority liens on the company’s assets) are being used to pay suppliers, employees, and other operating expenses during bankruptcy – essentially keeping the lights on while the company seeks a buyer. Notably, the DIP included fresh capital ($165 million of new funding), which provides critical liquidity for seasonal inventory builds and other needs. By securing this financing, Del Monte signaled to the market and its partners that it can continue “business as usual” in the near term despite the Chapter 11 filing.

Parallel to stabilizing operations, Del Monte Foods – with oversight of the bankruptcy court – is conducting an auction process to sell the company or its assets. The RSA with the lender group set the initial roadmap: the lenders agreed to support a going-concern sale and are positioned to credit bid a portion of their debt to acquire the assets if no better bids emerge. In early court hearings, the company received approval to proceed with sale procedures and to designate a stalking-horse bid – currently a consortium of its term-loan lenders – that will serve as an opening bid for the auction.

Under the proposed terms, those lenders would roll up $247.5 million of pre-petition debt into the DIP (and ultimately into their bid) to set a floor price for the company’s assets. Having a stalking-horse bidder (in this case, the lenders using debt credit) provides a baseline value for the company and can discourage low-ball offers.

However, Del Monte is also encouraging competing offers. In fact, at the behest of creditors, the company recently tweaked its auction rules to attract more bidders – giving potential buyers more time and flexibility – in an effort to maximize stakeholder value. Potential strategic buyers could include other food manufacturers looking to acquire Del Monte’s well-known brands and U.S. shelf space, or private equity firms interested in turning around the business. Industry experts note that consolidation in the packaged food sector might spur interest. For instance, a competitor might view Del Monte’s canned goods portfolio as complementary to their products, or a financial buyer might see an opportunity to streamline operations and improve margins.

The timeline for the sale is moving quickly under court supervision. Del Monte’s goal is to conclude the bidding and have a sale approved within the Chapter 11 case, possibly by late 2025 or early 2026. During this period, the company is protected by the automatic stay (a legal moratorium that halts creditor collection actions), giving it breathing room to find the best path forward. Del Monte’s management and advisers are working diligently to prepare data rooms, meet with interested parties, and evaluate offers. It’s a complex process that requires balancing speed (to limit time in bankruptcy and preserve value) with thoroughness (to ensure they secure the highest and best offer available).

So far, creditors and the court have mainly supported the restructuring plan, though not without some contention. Notably, a group of lenders who were not part of the RSA raised objections to the DIP financing terms at the first-day hearing. They argued that the DIP’s proposed roll-up of $247.5 million in pre-petition debt into post-petition status was excessive and would unfairly advantage the participating lenders. Judge Kaplan, overseeing the case, acknowledged the concerns but ultimately approved the interim DIP facility, citing the lack of any immediate alternative and the risk of irreparable harm if financing were denied.

He noted there were “no other options” on the table at that moment, and he was not willing to gamble with the company’s fate. This early legal sparring indicates there may be some creditor friction as the case progresses (for instance, between different lender factions or between lenders and trade creditors). Still, to date, Del Monte has obtained the critical approvals needed to keep the process on track. The company’s management expressed gratitude that stakeholders are enabling a path to a “stronger, enduring Del Monte Foods” through a sale and new ownership.

Soft freight demand, tariffs, and higher input costs intensify supply‑chain pressures.

Crucially, the strategy is to sell Del Monte as a going concern, meaning the business would continue operating under a new owner rather than being liquidated piecemeal. This bodes well for employees, customers, and suppliers who rely on the company. A going-concern sale would likely involve the transfer of key contracts (including many supply and logistics contracts) to the buyer. Depending on the buyer’s plans, some agreements might be assumed or renegotiated, while others could be rejected (terminated) in the bankruptcy with court approval.

For example, if a buyer intends to keep using a particular third-party warehouse or carrier, they will assume that contract; if not, they might choose to end it and handle distribution differently. These decisions will be part of the Chapter 11 sale process and subject to negotiation and court approval. For now, all indications are that Del Monte’s operations will remain intact through the transition. The outcome – whether a sale to an outside investor or a transfer of ownership to the lender group – should become clearer as the auction and court hearings advance in the coming months.

Root Causes of Del Monte’s Financial Trouble: Debt, Demand Slump, and Competition

- Excessive Debt and Interest Burden: Del Monte Foods had taken on substantial debt in the past decade, including a primary refinancing in 2023 that added leverage in anticipation of growth. Unfortunately, the expected sales boost did not materialize. The company was left servicing high debt levels just as earnings began to stagnate. By 2025, Del Monte was overleveraged and facing staggeringly high interest payments on its loans – court filings indicated that annual interest expense exceeded the company’s operating earnings, an unsustainable situation. Simply put, the debt load became unmanageable, consuming cash flow and leaving historically low liquidity. When a company’s debt service outpaces its profits, a restructuring or bankruptcy often becomes inevitable unless new equity capital comes in, which, in Del Monte’s case, did not happen (the parent DMPL declined to inject further funds, as noted above). The $912.5 million DIP financing in Chapter 11 is essentially replacing the prior debt for now, but long-term, the plan is to shed a large portion of this debt via the sale to restore balance-sheet health.

- Weakening Consumer Demand and Inventory Glut: Del Monte experienced a post-pandemic demand slump for its packaged products. During the peak of the COVID-19 pandemic, canned and shelf-stable foods saw a surge in demand, but that trend reversed as consumers returned to fresh and perishable options. Del Monte reportedly overestimated demand and built up excess inventory in 2023. In an affidavit, the company’s Chief Restructuring Officer noted that Del Monte committed to large production volumes for the 2023 pack season based on the elevated pandemic-era demand, only to see orders drop when consumer buying patterns normalized. The result: Del Monte was left with substantial excess inventory that it had to store, write off, or sell at steep discounts. This inventory glut hurt cash flow and profitability. In response, the company closed certain production facilities in 2023–2024 to cut costs and reduce output (for example, shutting canning plants in Wisconsin and Washington and selling a California facility). While these closures saved some money in the long run, they came with one-time expenses and signaled that the company’s footprint had been too large for its actual sales volume. The overall weak consumer demand for traditional canned fruits and veggies – especially compared to the pantry-loading highs of 2020 – meant Del Monte couldn’t grow its way out of its financial problems.

- Inflation and Rising Costs: Like many manufacturers, Del Monte Foods was hit by inflationary pressures in its supply chain. The costs of raw produce, packaging materials (e.g., tinplate steel for cans), labor, and transportation all rose sharply in 2022–2024. The company faced inflation-driven cost increases that squeezed its margins. It tried to pass some of these costs to consumers through price increases, but in a price-sensitive category, that often led to volume declines or pushed some buyers toward cheaper alternatives (store brands). Del Monte also had to spend more on promotions and trade discounts to move product, further straining liquidity. Essentially, the company was caught between higher input costs and an inability to raise prices enough, leading to profit erosion. For instance, tariffs on imported tinplate (used for cans) and general commodity inflation drove up Del Monte’s expenses. The company’s bankruptcy filings noted that higher promotional spending and outsized production commitments (resulting in excessive production that required discounting) also contributed to its cash crunch.

- Shift in Consumer Preferences and Competition: A broader industry trend has been the growing consumer preference for fresh, organic, or minimally processed foods, as well as the rise of private label (store-brand) products. These trends worked against legacy canned goods producers like Del Monte. Shoppers, especially younger ones, have been gravitating more to fresh produce or frozen options for fruits and vegetables; when they do buy canned goods, they often opt for cheaper retailer-owned brands, which have improved in quality and marketing. Del Monte and similar brands have struggled to adapt quickly to this changing market landscape. The company’s filings acknowledged that evolving consumer preferences and the rise of retailer private labels put pressure on Del Monte’s sales and market share. Retailers have been allocating more shelf space to their brands and alternative products, forcing legacy brands to fight harder to justify their premium and hold shelf position. Del Monte saw declines in some of its private-label manufacturing business as well (since some grocery chains shifted to other suppliers or reduced orders). In short, the company was operating in a slowly shrinking segment of the market and had not found a new growth engine to offset that decline. This competitive backdrop made it difficult for Del Monte to increase revenue or margins, even as costs were rising.

- Operational Missteps and One-Time Factors: Alongside these significant issues, Del Monte Foods made some operational and financial decisions that were unsuccessful. The court filings reference “outsized production commitments” and other execution missteps – essentially, the company overcommitted to production and procurement based on overly optimistic forecasts, which left it with too much inventory and related costs. The company also engaged in a complex liability management transaction (LME) in August 2024, raising $240 million in new debt in an attempt to buy more time and refinance its obligations. However, that stopgap financing wasn’t enough to fix the core issues; in fact, it added to the debt load that now must be restructured. (That 2024 deal even led to some legal disputes among lenders, which were settled before the bankruptcy.) All these factors culminated in a classic liquidity crisis: by mid-2025, Del Monte Foods was running critically low on cash and unable to meet its obligations without a comprehensive restructuring. The Chapter 11 filing became the mechanism to address these structural problems and seek a new owner with fresh capital.

Restructuring aims for a going‑concern sale to preserve brands, jobs, and distribution. (Del Monte® Plover Plant. Corey Coyle, CC BY 3.0)

In summary, Del Monte Foods’ bankruptcy was not an overnight development but the result of years of mounting pressures – a heavy debt burden, a post-pandemic drop in demand, rising costs, shifts in consumer behavior, and some failed strategic bets. As CEO Greg Longstreet noted, “we have faced challenges intensified by a dynamic macroeconomic environment”, yet the brand’s long history shows it can be resilient.

The Chapter 11 process, while painful for creditors and stakeholders, offers a chance to reset the company’s finances. If victorious, Del Monte could emerge with a stronger balance sheet (much less debt), possibly new owners with fresh strategic ideas, and a renewed focus on its core mission of providing convenient, nutritious foods. Industry observers suggest that to thrive post-bankruptcy, Del Monte will need to innovate – whether through new product lines, marketing to younger consumers, or further streamlining of costs – once it gets past this immediate financial crisis.

Will Del Monte Foods continue operating during Chapter 11?

Yes. Del Monte Foods is continuing normal operations during the Chapter 11 process, thanks to the DIP financing and court orders that support business continuity. The company obtained $912.5 million in DIP funds to ensure it can pay for ingredients, packaging, labor, and logistics while in bankruptcy. The bankruptcy court approved “first day” motions that allow Del Monte to keep operating in the ordinary course, without interruption. This means employees are being paid on schedule, suppliers providing goods or services after the filing are being paid (as administrative priority claims), and customers should see no disruption in the availability of Del Monte products.

In fact, Del Monte explicitly noted that its production “pack” season – the critical summer period when freshly harvested fruits and vegetables are canned – would proceed as planned, with sufficient liquidity to fund production. The Chapter 11 filing essentially freezes pre-petition debts but provides the company with breathing room and new financing to carry on day-to-day operations. From the outside, consumers and retailers should notice little difference: Del Monte’s canned corn, pineapples, peaches, tomatoes, and other products remain on store shelves, and shipments continue to go out.

The expectation is that operations will remain steady through the sale process and that the eventual new owner will take over the business seamlessly. In short, Chapter 11 is allowing Del Monte to operate “business as usual” while it restructures – the company continues to fulfill orders and serve customers as it seeks a stable future.

How will Del Monte Foods’ bankruptcy affect suppliers and carriers?

Operations continue under DIP financing as Del Monte pursues a going-concern sale—the winning bid will determine creditor recoveries and supply-chain stability.

For Del Monte’s suppliers and carriers, the bankruptcy has a two-fold impact: treatment of past debt and conditions for future business. First, any unpaid invoices from before the July 1 filing are now locked into the bankruptcy process. Those suppliers and freight carriers holding unsecured claims (which is the case for virtually all trade creditors here) will not receive payment for those old invoices until the bankruptcy is resolved – and even then, it will likely be only a partial payment. Unsecured trade creditors are lower priority in repayment, so their recovery might be only pennies on the dollar, depending on the sale outcome.

For example, a trucking company that hauled loads for Del Monte in June 2025 and wasn’t paid by the time of the filing now has to file a claim in the Chapter 11 case and wait. It could end up receiving, say, 50% of that amount a year or more later – or possibly less, if the sale proceeds mainly go to secured lenders. This uncertainty and potential loss is a direct hit to those trade partners’ finances. Many suppliers and carriers will have to write off a portion of the Del Monte debt as a bad debt expense on their books, which will affect their earnings for the period.

On the other hand, ongoing and future business with Del Monte Foods can continue under tighter safeguards. Suppliers and logistics providers have the opportunity to keep serving Del Monte during Chapter 11, but typically on adjusted terms to protect themselves. In many cases, vendors switch to cash-on-delivery (COD) or require payment in advance for shipments, since they don’t want to accumulate new unpaid receivables during the bankruptcy. Understand the strategies being employed in logistics to navigate industry challenges, see our Logistics section.

The bankruptcy court may also authorize Del Monte to treat certain vendors as “critical suppliers” – allowing the company to pay some pre-petition amounts to those vendors – if their goods or services are essential to operations. (For instance, a packaging supplier crucial to Del Monte’s production might get such critical-vendor protection to ensure they continue supplying cans or labels.)

For carriers and freight brokers, as noted earlier, post-petition freight moves are being paid for out of the DIP budget, which gives them priority status for payment. So carriers who continue hauling Del Monte loads after July 1, 2025, should be paid in full for those new loads, with costs coming on time per the new arrangements. Uber Freight’s statement exemplifies this dynamic: they remain committed to hauling for Del Monte and are confident they’ll receive full payment for services provided post-filing. Essentially, Del Monte’s partners are protected on new transactions, but they will likely absorb some loss on old debts.

In practical terms, some smaller suppliers who cannot afford any loss or extended non-payment might choose to halt doing business with Del Monte until it exits bankruptcy (to avoid further risk). Larger partners, however, appear to be continuing, especially if the ongoing revenue from Del Monte is significant and the company’s DIP financing assures payment for new orders. Suppliers also know that if they stick with Del Monte through the rough patch, they could benefit from a stable long-term relationship once the company reorganizes.

There is also more transparency now – suppliers and carriers can monitor court filings to get updates on Del Monte’s status, which isn’t usually possible when a customer is privately struggling. (For example, they will eventually see a proposed plan or sale terms indicating how much they might recover on old invoices.) Trade creditors indeed have formed an official committee, as mentioned, to represent their interests and negotiate on their behalf. This can sometimes lead to slightly better recoveries or at least a voice in the process.

To summarize, Del Monte Foods’ bankruptcy means short-term pain for suppliers and carriers in the form of unpaid past bills, but it does not necessarily mean the end of the relationship. Those companies can still ship to and transact with Del Monte during and after bankruptcy, with safeguards for new deliveries. The key distinction is that any pre-bankruptcy unsecured debt is at risk; those partners must brace for a potential partial loss there. As we advance, assuming Del Monte successfully finds a buyer and restructures, the suppliers and carriers will be dealing with a hopefully financially healthier customer.

The hope among many trade partners is that a restructured Del Monte (with less debt and new investment) will be more stable and better able to pay its bills on time, which would benefit the supply chain in the long run. For now, though, caution is the rule: carriers, warehouses, farmers, and other vendors tied to Del Monte are proceeding carefully, ensuring they are not overextended, and watching the bankruptcy proceedings closely as the Chapter 11 process determines how their pre-petition claims will be handled. Some may diversify their customer mix to rely less on the Del Monte business, while others may deepen ties in anticipation of the company’s successful turnaround under new ownership.

Key Developments — Del Monte Foods Chapter 11

- Petition & venue: Filed July 1, 2025, in the District of New Jersey; joint administration before Judge Michael B. Kaplan (Case No. 25‑16984).

- Scale of case: Schedules list $1B–$10B in assets and liabilities and 10,000–25,000 creditors — one of the largest recent food‑sector filings.

- Operating continuity: Court-approved first‑day relief and $912.5M DIP financing (with $165M new money) to fund operations, including the 2025 pack season.

- Sale strategy: Company pursuing a court‑supervised going‑concern sale under an RSA with key lenders; stalking‑horse bid in place (lenders credit bidding ~$247.5M) and bidding procedures approved.

- Key dates: Aug 12, 2025, omnibus hearing on final DIP approval and bidding procedures; Aug 28, 2025, §341 meeting of creditors (initial creditors’ meeting).

- Committee formed: U.S. Trustee appointed an official committee of unsecured creditors on July 17, 2025.

- Top logistics exposures: Transplace/Uber Freight (≈$9M), ES3 (≈$4.0M), Saddle Creek (≈$1.35M), CHEP USA (≈$470K); Blue Book also lists Steuben Foods (≈$6.98M) as a significant trade creditor.

- Post‑petition freight: Uber Freight says it expects full payment for post‑filing services (company designated as critical logistics partner); standard Chapter 11 priority rules protect post-petition obligations.

- Parent relationship: Filing covers the U.S. unit; non‑U.S. subsidiaries are excluded and continue normal operations (DMPL to deconsolidate U.S. business).

- Drivers of distress (context): demand normalization after pandemic surge, excess inventory, elevated costs (inflation, tariffs), rising interest burden; prior $240M Aug 2024 debt raise (LME) provided liquidity but did not avert the filing.

Authoritative Sources on Del Monte Foods’ Chapter 11 & Supply‑Chain Implications

- Company announcement: Del Monte Foods enters Chapter 11 and launches court‑supervised sale (July 1, 2025) — PDF delmontefoods.com

- Official bankruptcy case portal & docket (Case No. 25‑16984, D.N.J.) — pleadings, deadlines, claims cases.stretto.com/delmontefoods

- Voluntary petition (primary filing document) — PDF (public docket copy) cases.stretto.com …/PLEADINGS/…0205.pdf

- Judge Michael B. Kaplan — profile & courtroom procedures (U.S. Bankruptcy Court, District of New Jersey) njb.uscourts.gov

- Chapter 11 Bankruptcy Basics — official explainer (U.S. Courts) uscourts.gov

- §341 Meeting of Creditors — overview & guidance (U.S. Trustee Program, DOJ) justice.gov/ust/meeting-creditors

- U.S. Trustee notice re: formation of unsecured creditors’ committee (Del Monte case) — PDF justice.gov — committee notice

- Parent perspective: Del Monte Pacific Limited (DMPL) — SGX announcement on U.S. unit’s Chapter 11 & deconsolidation delmontepacific.com/sgx-press-releases

- DMPL FY2024 Annual Report — background on non‑U.S. operations and structure (PDF) delmontepacific.com …FY2024 Annual Report

- Del Monte Foods Fiscal 2024 Audited Financial Statements — historical performance (PDF) delmontefoods.com …Fiscal 2024 Audited FS

- Transplace ↔ Uber Freight tie‑up (context for creditor listing): Uber Freight completes acquisition of Transplace (press release) investor.uber.com

- Uber Freight — solutions overview (enterprise TMS, brokerage, capacity) uberfreight.com

- Saddle Creek Logistics Services — company overview (warehousing, transportation, fulfillment) sclogistics.com/about-us

- ES3 — transportation network & grocery distribution es3.com/transportation

- CHEP USA — how pallet pooling works (circular, share‑and‑reuse model) chep.com …/how-chep-works

- Tin mill (tinplate) trade case background: ITA final determinations page (AD/CVD investigations) trade.gov — ITA tin mill determinations

- USITC determination on tin mill products — Commission decision & explanation usitc.gov — news release

- PACER — official public access to federal court records (for complete docket materials) pacer.uscourts.gov