- Page Trucking Goulet merger: how a national specialized bulk transport network pairs with a New England fleet built for hazmat transport and regulated waste streams.

- The operational strategy behind the scale: smarter asset pooling across tank trailers, roll-off services, and overweight loads to reduce empty miles and tighten turns.

- What to watch for during the planned Q1 2026 close: DOT compliance alignment, dispatch integration, and how documentation workflows could affect shipper service consistency.

Page Trucking marks 50 years in specialized bulk hauling, providing the foundation for the new Page G.T.C. Inc. platform.

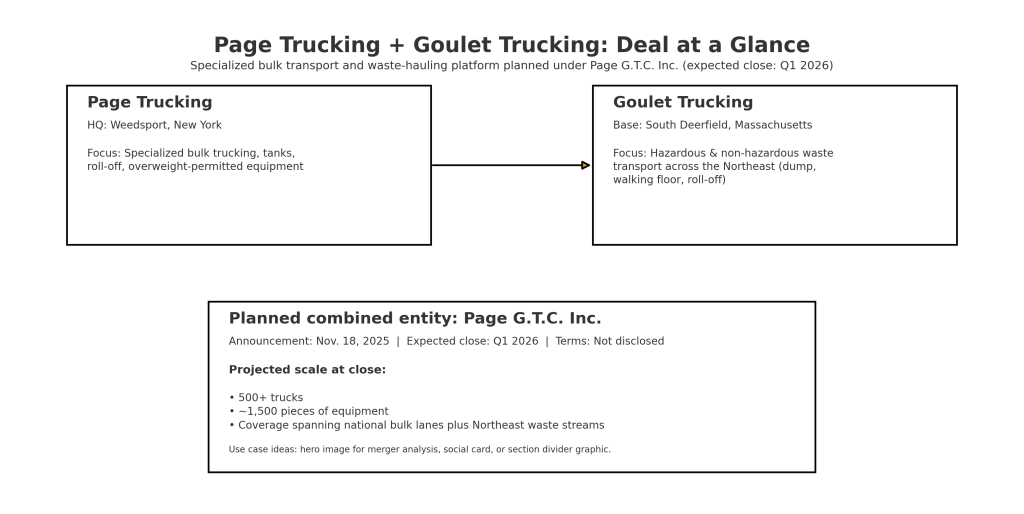

Page Trucking Goulet merger plans to unite two family-owned operators into a single specialized bulk and waste-hauling platform under Page G.T.C. Inc., with the companies projecting 500+ trucks and 1,500 pieces of equipment once the deal closes. The agreement was announced on November 18, 2025, with closing expectations in Q1 2026. Financial terms have not been disclosed. For more news and updates on acquisitions in the freight industry, check out this page.

For transportation, logistics, and bulk freight professionals, the Page Trucking Goulet merger is notable less for headline optics and more for what it consolidates: northeast hazardous and non-hazardous waste logistics, interstate specialized bulk trucking, and a wider set of equipment classes—from tank trailers and pneumatics to roll-off services, semi-dumps, and overweight loads managed with permitted configurations. For additional insights into developments in the tank trailers segment, explore this page.

The transaction also formalizes a partnership model. Rather than a conventional absorption, the Titus family (Page Trucking) and the Goulet family (Goulet Trucking) are forming a new entity—Page G.T.C. Inc.—with an integration plan that states both companies will maintain personnel and operate under a combined senior leadership team. In practical terms, freight customers should evaluate how network overlap, equipment utilization, and compliance harmonization translate into day-to-day service performance. To explore additional stories about developments in the tank transport sector, visit this link.

At-a-glance: What the market knows now

- Deal announced: November 18, 2025

- Expected close: First quarter 2026

- Projected scale: 500+ trucks, 1,500 pieces of equipment

- Company structure: New entity Page G.T.C. Inc., formed by both families

- Workforce indicators (FMCSA snapshots): Page Trucking 202 drivers; Goulet Trucking 110 drivers

Page Trucking Goulet merger: Deal Overview, Timing, and Why It Matters

Goulet Trucking brings 50 years of New England dump and waste-hauling experience into the Page Trucking Goulet merger.

Enjoying our insights?

Subscribe to our newsletter to keep up with the latest industry trends and developments.

Stay InformedThe Page Trucking Goulet merger is positioned as a capacity-and-capability combination in a market segment that is inherently operationally demanding. Bulk freight is equipment-intensive, margin-sensitive, and heavily influenced by cycle timing. Waste hauling adds additional layers: regulated materials, tight documentation requirements, disposal destination constraints, and a higher premium on safety practices tied to DOT compliance and hazmat standards. Stay updated on the latest trends in bulk transportation, check out this link.

From a coverage standpoint, the logic is straightforward. Page Trucking brings a broad multi-state footprint and an equipment mix that spans core bulk hauling and specialty niches (including tank and molten movements). Goulet Trucking anchors a concentrated New England fleet with deep penetration in waste streams such as contaminated soils, sludge, ash, and municipal solid waste. That complementarity often matters more than raw tractor counts because it reduces the “capability gap” that shippers perceive when awarding complex projects. For additional insights into other significant industry mergers, browse our Mergers section.

The planned close in Q1 2026 creates a practical window for integration work before the peak construction and remediation seasons typically ramp in many Northeast markets. That timing is relevant for customers with spring and summer project calendars—especially those tied to environmental remediation, municipal waste flow, construction demolition (C&D) cycles, and industrial shutdown work.

The Page Trucking Goulet merger also signals a continued industry preference for scale in specialized segments. Consolidation does not automatically improve service quality, but it does often improve a carrier’s ability to absorb volatility—fuel swings, insurance costs, surge staffing, and seasonal equipment demand—if integration is executed with discipline. Stay abreast of the latest trends shaping consolidation in the trucking industry by clicking here.

Operational watchlist: what bulk and tank shippers should monitor

- Dispatch continuity: whether service lanes remain stable during the leadership transition.

- Equipment pooling rules: how the combined company reallocates trailers across terminals to reduce empty miles.

- Safety governance: how Goulet’s waste-focused safety standards align with Page’s multi-commodity operations.

- Documentation systems: whether waste manifests, customer portals, and ELD/telematics workflows converge cleanly.

- Contracting and accessorials: whether the combined entity standardizes charges for detention, standby, permit moves, washouts, and disposal-related dwell.

Deal at a glance: Page Trucking and Goulet Trucking plan to combine under Page G.T.C. Inc., targeting a Q1 2026 close with more than 500 trucks and about 1,500 pieces of equipment.

Significantly, nothing in the announced structure changes the fact that bulk freight and waste hauling are still won and retained at the load level: on-time performance, incident rates, paperwork accuracy, trailer availability, and the carrier’s ability to absorb operational surprises. The Page Trucking Goulet merger should be evaluated against those measurable outcomes—not just projected fleet size. Understand the strategies being used to manage fleets and optimize outcomes by exploring this link.

Company profiles inside the Page Trucking Goulet merger

When shippers and brokers assess the Page Trucking Goulet merger, they typically start with capabilities: what equipment is available, what trained labor is retained, and what commodity mix can be handled without subcontracting. The second layer is network logic: how the combined company’s terminal geography and permitting footprint reduce handoffs and improve trailer turns.

Below is a pragmatic profile approach—focused on assets, commodity mixes, and compliance posture—built for procurement teams, fleet managers, and logistics coordinators who need detail beyond press-release language.

| Category | Page Trucking | Goulet Trucking |

|---|---|---|

| Core positioning | Nationwide specialized bulk trucking with diverse trailer types and specialty configurations | New England‑anchored bulk dump and waste hauling with a hazardous and non‑hazardous focus |

| Workforce signals | FMCSA snapshot indicates 202 drivers | FMCSA snapshot indicates 110 drivers |

| Notable equipment classes | Semi‑dumps, tank/pneumatic, roll‑offs, flatbeds, tippers, molten, custom multi-axle | Dump trailers, walking floors, roll‑offs, on‑site loaders; waste stream handling. |

| Regulated freight posture | Roll‑off program includes hazardous materials; tank operations with experienced liquid drivers | Waste hauling emphasis: safety standards include HAZWOPER‑trained drivers and maintenance above the FMCSA baseline |

| Geographic strength | Broad interstate reach with strong Northeast roots | Dense Northeast coverage; also advertises availability across the U.S. and into Quebec/Ontario |

Page Trucking: multi‑modal bulk, tanks, roll‑offs, and overweight capability

A Page Trucking bulk trailer and highway tractor illustrate the specialized equipment that will anchor the new Page G.T.C. Inc. platform.

In the Page Trucking Goulet merger, Page Trucking is the platform with breadth—both in commodity coverage and in equipment types. Page describes semi-dump trailers as the core of its fleet, dispatched across all locations, with some units configured to handle both palletized and bulk freight. Many of those semi-dump operations run under overweight permits, which is a meaningful differentiator in segments where density drives economics (scrap, aggregates, industrial residuals).

For tank transport professionals, Page’s equipment catalog is particularly relevant. Page maintains tank/pneumatic trailers with stated capacities of 5,000–7,500 gallons and specification options including MC407 and MC412, as well as stainless steel or aluminum configurations. Page indicates that these tank units are operated by drivers with an average of 15+ years of experience in liquid tank transportation. In practice, that kind of tenure matters in loading discipline, surge management, safe parking routines, and pump/valve familiarity.

Page also runs a substantial roll‑off trailer program with sludge-type boxes, water-tight tarps, and stated capacities ranging from 20 to 74 cubic yards. The company positions these units as versatile across a wide range of commodities, including hazardous materials and scrap. That versatility becomes strategically essential when combined with Goulet’s waste-stream expertise, as it can reduce the need to broker specialized waste moves.

On the specialty end, Page lists custom equipment options including vans up to eight-axle configurations, walking floors, and build-to-spec multi-axle setups that differ from standard tandems. The reason this matters in the Page Trucking Goulet merger is not marketing variety—it’s the flexibility to match equipment to disposal site requirements, scale limits, access roads, and density constraints.

Page also highlights a tractor-mounted tipper fleet, promoted as the largest of its type, designed to optimize payload by removing the need for trailer-mounted tipping hardware. Operationally, tractor-mounted tippers can improve turnaround at sites where unloading geometry and floor constraints create bottlenecks. That becomes a tool for enhancing trailer utilization when combined volumes increase after the merger.

Flatbed offerings further broaden Page’s scope. Page lists flatbeds with options such as open flats, side kits, and drop-decks, sized around 40–48 feet and 96–102 inches wide, with stated payload capability of 45,000 to 82,000 lbs with permits, and “lightweight” aluminum configurations capable of higher payloads in specific scenarios. While flatbed freight is not a core waste-hauling service, it allows a bulk operator to support adjacent supply chains that require specialized gear, jobsite materials, or containers with different deck formats.

Finally, Page lists a molten trailer fleet with one-, two-, and three-pot configurations, heavy-haul-permitted options, removable or stationary crucibles, and payloads up to 33,000 lbs with a single pot (or more where overweight-permissible). The molten niche is a reminder that Page’s customer base likely includes industrial accounts with stringent scheduling needs—accounts that may also generate waste streams and residuals, for which Goulet’s capabilities are additive.

Outside equipment, Page also advertises services beyond linehaul. Its offerings include warehousing and material management—bulk storage, inventory management, and tolling services such as baling, bricking, sorting, and transloading—plus complete site service management. For shippers, those services can reduce touchpoints, particularly when bulk materials hauling intersects with staging, packaging, or recycling workflows.

As another differentiator, Page notes it is a WBENC‑certified woman-owned enterprise. For some industrial procurement programs, that certification can influence supplier diversification strategies—though it should be viewed as a procurement attribute rather than an operational guarantee.

Goulet Trucking: New England waste hauling fleet and hazardous waste logistics

Goulet Trucking adds a dense New England dump and waste-hauling fleet to the Page Trucking Goulet merger.

In the Page Trucking Goulet merger, Goulet Trucking brings concentration and specialization. The company describes itself as a family-owned bulk dump and waste hauler in New England with over 40 years of operating history. That local density—paired with waste-stream experience—is often what enables consistent performance in a region where disposal options, jobsite constraints, and winter operations can make schedules fragile.

Goulet places an explicit emphasis on safety standards. It states a safety track record built over decades, including HAZWOPER‑trained drivers and vehicles maintained above FMCSA standards. In hazardous waste hauling, these aren’t aesthetic claims; they directly affect incident probability, inspection outcomes, and the carrier’s ability to keep equipment available rather than sidelined for compliance issues.

Goulet’s service menu is unusually transparent for a regional carrier, which helps procurement teams scope fit. Under “remove it” services, the company lists materials such as contaminated soils, hazardous waste, municipal solid waste, coal and incinerator ash, scrap metal, sewage treatment plant sludge, paper sludge, crushed glass, recyclables, demolition debris, and asbestos waste. This breadth suggests exposure to both municipal and industrial waste streams, with operational implications for trailer cleanout practices, documentation discipline, and driver PPE routines.

Under “deliver it,” Goulet lists road salt, compost, limestone, bark mulch, fertilizer, decorative landscape stone, and construction aggregates—materials that align with seasonal demand swings and municipal purchasing cycles. Under “move it,” the company references heavy equipment movement, indicating a jobsite support capability that can matter for remediation and construction projects.

From an equipment standpoint, Goulet provides specific guidance on trailers and capacity that logistics teams can plan against. It lists dump trailers in the 55-70 cubic yard range with 20–39 ton payloads, where applicable, commonly used for soils, demolition, salt, aggregates, compost, coal, and related bulk materials.

Goulet also lists walking floors in the 104–140 yard range with 29–39 ton capacity. Walking floors are particularly relevant in municipal solid waste and demolition environments where tipping is not feasible or where indoor unloading and floor limitations require controlled discharge.

For roll-off operations, Goulet lists 20, 25, and 30 cubic yard roll-off configurations used for sludge, ash, contaminated soil, hazardous wastes, and ACM (asbestos-containing material) debris. It also notes on-site work support with bucket loaders in the 4–7 cubic yard class, used to load salt, aggregates, contaminated soil, coal, ash, and sludge. That detail matters because on-site loading capability can remove dependence on third-party loaders and reduce project friction.

The company also indicates it specializes in hauls throughout the Northeast while being available for transport throughout the U.S. and into Quebec and Ontario. It further states it is licensed to haul hazardous waste in specific jurisdictions, including:

- Connecticut, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Vermont, Virginia

- Ontario (Canada) and Quebec (Canada)

For shippers, the listed licensing footprint can reduce handoffs. In waste logistics, each handoff increases the risk of dwell time, documentation errors, and claims. In the Page Trucking Goulet merger, the most immediate value for customers may be a higher probability that a single carrier network can handle multi-state waste movement without resorting to patchwork subcontracting. For more news and updates on hazardous waste transportation across the industry, check out this page.

What does the Page Trucking Goulet merger mean for shippers and carriers?

Goulet Trucking’s long-standing New England brand now becomes part of the Page G.T.C. Inc. combined fleet.

At the highest level, the Page Trucking Goulet merger is a scale event inside a specialized niche—not a general dry-van consolidation. That distinction matters because bulk and waste hauling markets behave differently from linehaul van freight. Trailer pools are tighter, labor is more specialized, and the cost of non-compliance is higher.

Capacity is the first obvious implication. A projected 500+ truck fleet changes how customers think about surge coverage during seasonal peaks (road salt, construction aggregates, cleanup projects), and how national shippers think about lane continuity across regions. If executed well, a bigger combined fleet should improve the odds that contracted capacity shows up when promised.

But scale cuts both ways. The second implication is integration risk. Operational disruptions most often come from the “invisible layers” of trucking: dispatch handoffs, inconsistent equipment coding, mismatched EDI expectations, and delayed documentation workflows. The Page Trucking Goulet merger reduces those risks if leadership keeps processes stable during transition and avoids forcing abrupt standardization before systems are ready.

The third implication is equipment utilization. Both companies have explicitly pointed to synergies from improved utilization. In bulk operations, utilization is frequently the difference between a profitable quarter and a marginal one. A combined organization can reposition trailer types across terminals more intelligently—sending walking floors into municipal waste cycles, sending roll-off boxes into sludge/ash work, and balancing tank/pneumatic assets to meet liquid demand.

The fourth implication is hazmat and hazardous waste competence at scale. Goulet’s safety posture—emphasizing HAZWOPER training and above-baseline maintenance—paired with Page’s diversified equipment base can create a more comprehensive hazardous-handling platform. This matters for customers handling contaminated soils, industrial by-products, and liquid commodities where hazmat transport procedures are non-negotiable.

The fifth implication is network resilience in the Northeast. New England is a demanding operating environment: winter weather, constrained disposal access, jobsite restrictions, and elevated urban congestion. Goulet’s localized density is a stabilizing asset. Coupled with Page’s broader interstate reach, the combined network may reduce empty miles and improve backhaul options—particularly for shippers who can offer balanced flows of bulk materials hauling and waste removal.

The sixth implication is procurement leverage and supplier strategy. Larger fleets often become attractive “primary carrier” candidates. Yet some shippers prefer maintaining multiple carriers to reduce dependency risk. The Page Trucking Goulet merger may lead some customers to consolidate spend, while others use the combined entity as one component of a diversified carrier portfolio.

The seventh implication is the expansion of the service portfolio. Page’s material management and tolling offerings—bulk storage, inventory management, and transloading—can complement waste-hauling work that involves staging and sorting. For customers, fewer vendors can mean fewer points of failure, but it also concentrates performance accountability.

Practical questions to ask your carrier rep after the Page Trucking Goulet merger

- Which terminal will manage our freight: the existing local location or a centralized dispatch desk?

- Will trailer types and numbers available to our account change during Q1–Q2 2026?

- How will waste documentation, manifests, and load photos be captured and stored?

- What is the process for incident reporting and claims escalation under Page G.T.C. Inc.?

- Will billing formats, accessorial definitions, or detention rules change post-close?

The bottom line is that the Page Trucking Goulet merger can deliver tangible benefits—especially in constrained bulk and waste lanes—if integration protects what already works operationally. Shippers should expect a period of process refinement and watch for early indicators, such as trailer availability, paperwork accuracy, and consistency in dispatch communication.

Page Trucking Goulet merger FAQs for dispatch, safety, and procurement

Will the Page Trucking Goulet merger change capacity and pricing in the Northeast?

The safest answer is that capacity is likely to increase in practical availability, while pricing outcomes depend on lane conditions. The Page Trucking Goulet merger creates a larger combined equipment pool and a broader driver base, which can reduce the odds of “no truck available” outcomes—particularly during seasonal peaks and project surges.

However, pricing for bulk and waste hauling is driven by multiple factors beyond fleet size: disposal site dwell time, regulatory requirements, distance to the disposal site, permit constraints on overweight loads, and specialized trailer requirements (walking floors vs. end dumps vs. roll-offs vs. tanks). Even with the Page Trucking Goulet merger, those constraints can keep specific lanes tight.

Customers should consider separating the two questions: “Will I get a truck?” versus “Will the rate move?” The merger can improve the first by increasing access to equipment and dispatch flexibility. The second will remain tied to project complexity and the broader regional balance of waste generation and disposal capacity.

How will Page G.T.C. integrate hazmat permits, DOT compliance, and equipment standards?

The integration challenge is less about whether standards exist—and more about how they are applied consistently across a larger mixed fleet. The Page Trucking Goulet merger brings together operations that handle different risk profiles: industrial commodities and liquids on one side, and waste streams with hazardous and asbestos-related components on the other. Each requires different routines around cleaning, documentation, PPE, and routing controls.

A practical integration approach typically involves three parallel tracks:

- Compliance alignment: harmonizing DOT compliance, hazardous waste licensing workflows, and training records across terminals.

- Equipment standardization: setting consistent expectations for inspection, washout, tarp integrity, and containment across dump, roll-off, and tank equipment.

- Operational discipline: ensuring dispatchers and drivers share the same definitions for “ready trailer,” “clean trailer,” and “approved for hazardous” status.

Goulet’s stated emphasis on HAZWOPER training and maintenance above FMCSA standards provides a foundation for waste-specific safety governance. Page’s detailed equipment portfolio—especially tank/pneumatic and roll-off configurations—indicates a mature approach to specialized equipment management. The test for Page G.T.C. Inc. will be whether those strengths reinforce each other without introducing conflicting procedures.

From the outside, early signs of successful integration typically include: fewer documentation errors, stable inspection outcomes, more transparent communication at dispatch handoffs, and faster resolution when exceptions occur (missed appointments, disposal rejections, contamination flags, or jobsite access issues). For additional insights on evolving hazmat regulations and best practices in transportation, browse our Hazmat section.

Overall, the Page Trucking Goulet merger is poised to create a larger, more diversified specialist in bulk transportation, combining decades of operational experience, complementary equipment classes, and a deeper bench for regulated hauling. As the two companies combine under Page G.T.C. Inc., shippers should gain improved access to specialized trailers and experienced drivers—particularly in the Northeast—while the merged organization works through the practical realities of integration. If execution matches the stated goals, the combined platform has a credible path to innovate, scale responsibly, and lead in the specialized bulk transport sector. For more comprehensive insights and industry analysis on specialized transportation trends, visit our Industry Analysis section.

Key Developments: What the Page Trucking Goulet merger changes next

- Transaction timeline: announced Nov. 18, 2025, with an expected close in Q1 2026; financial terms not disclosed.

- New operating structure: formation of Page G.T.C. Inc. with a combined senior leadership team and stated intent to retain employees.

- Projected scale: combined platform expected to reach 500+ trucks and ~1,500 pieces of equipment, expanding capacity for specialized bulk freight.

- Geographic complement: Page adds broad interstate trucking reach; Goulet strengthens density in the Northeast trucking market, particularly for waste-related lanes.

- Service mix expansion: more integrated coverage across bulk materials hauling, dump operations, roll-off work, and tank-focused movements—reducing the need for multi-carrier handoffs on complex projects.

- Regulated freight capability: greater depth in hazardous and non-hazardous waste transportation, placing higher importance on consistent safety governance and documentation accuracy.

- Synergy targets: improved equipment utilization, optimized dispatch, and maintenance leverage—aimed at fewer empty miles and better trailer availability on peak-demand days.

- Integration watchouts for shippers: potential short-term friction around billing formats, accessorial definitions, dispatch handoffs, and documentation workflows during system alignment.

- Best next step for customers: confirm post-close points of contact, lane commitments, trailer type availability (tank/dump/roll-off), and escalation paths for compliance or service exceptions.

External References and Technical Sources for the Page Trucking–Goulet Merger

- Read the primary deal announcement in Page Trucking’s release on acquiring Goulet Trucking and forming Page G.T.C. Inc.

- Explore the company’s background and regional positioning at Goulet Trucking’s official website.

- Review waste-stream coverage and equipment services on Goulet Trucking’s services page for waste hauling, roll-offs, and walking floors.

- Verify carrier size and operating details via the FMCSA SAFER Company Snapshot for Page Transportation Inc. (USDOT 211745).

- Check fleet and driver counts on the FMCSA SAFER Company Snapshot for Goulet Trucking Inc. (USDOT 141707).

- Understand federal hazmat transport oversight at PHMSA’s Hazardous Materials Regulations (HMR) overview.

- Use highway-specific guidance in FMCSA’s “How to Comply with Federal Hazardous Materials Regulations” resource.

- Reference worker training and safety requirements in OSHA’s HAZWOPER standard (29 CFR 1910.120).

- Get the official hazardous waste regulatory framework from EPA’s RCRA regulations hub.

- Consult the technical rule text for hazardous waste identification at 40 CFR Part 261 (eCFR): Identification and Listing of Hazardous Waste.

- See inspection “pass/fail” enforcement thresholds at CVSA’s North American Standard Out-of-Service Criteria.

- Review federal truck weight baselines and state references in FHWA’s compilation of state truck size and weight limit laws.

- For cost benchmarks often tied to consolidation strategy, read ATRI’s 2025 Operational Costs of Trucking update.

- For tank-truck safety, education, and compliance resources, visit National Tank Truck Carriers (NTTC).